Yoti blog

Stories and insights from the world of digital identity

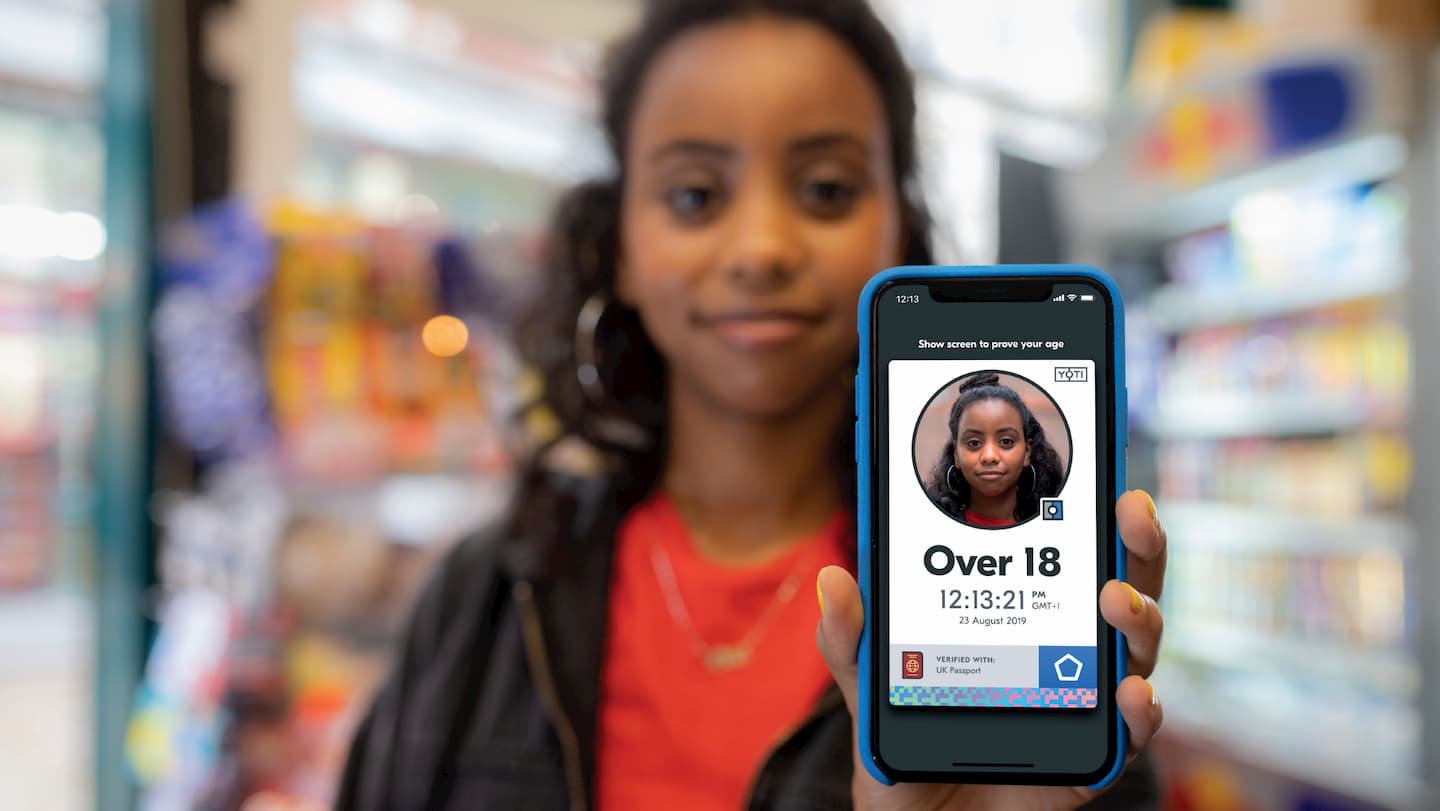

Report Remove - one year on

We’re immensely proud to be working with Childline and the Internet Watch Foundation (IWF) as part of our ongoing commitment to child protection. It’s been just over a year since we officially launched Report Remove, a tool to help young people report explicit images of themselves on the internet. To use the tool, a young person needs to prove they are under 18. Yoti gives a young person a private and safe way to prove their age, without needing to show ID documents or share personal data. We’re delighted that our tech is helping to make a difference in protecting

Play Verto research: young people’s attitudes towards facial age estimation

We joined forces with the team at Play Verto for an exciting piece of research to understand what young people thought about facial age estimation technology. Facial age estimation accurately estimates a person’s age based on a selfie. We built it to give everyone a secure way to prove their age without sharing their name or an ID document. The technology can help businesses to create age-appropriate experiences. It can prevent kids from accessing age-restricted content and platforms, and prevent adults from entering platforms for children and engaging with a younger demographic. The results Play Verto reached out to parents

How curio traders in Malawi could benefit from digital identity

As we go about our social purpose work we regularly get to speak to local, national and international non-profit organisations. Over the years, we’ve found that many struggle to understand the many ways digital identity solutions might help them in their work. As part of our wider efforts to help the sector make sense of the technology, today we’re publishing the last in a series of articles looking at the use of digital identities in six different humanitarian and environmental settings. Please note that, while the technology use case is real, the scenarios are hypothetical in nature, and the projects

GreenGrowth and Yoti power sustainable investments

25th August 2022 – GreenGrowth, the sustainable investment app, has partnered with digital identity provider Yoti, to give individual investors a modern way to prove their identity. When an individual creates a GreenGrowth account, they will no longer have to provide physical ID documents or go through a lengthy process to prove who they are. By using Yoti and their partner Post Office for digital identity verification, GreenGrowth can streamline the onboarding process, improve the customer experience, and strengthen KYC and AML checks. Under Financial Conduct Authority (FCA) rules GreenGrowth must check the identity of individuals and ensure they are

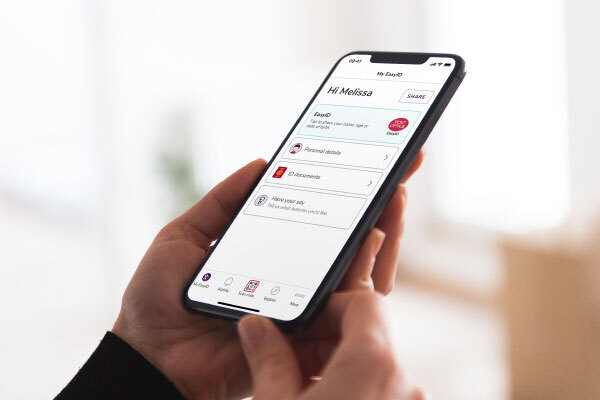

Post Office EasyID: a look back on the past year

It’s been 12 months since the Post Office EasyID app launched, giving people an easy and safe way to prove who they are. We’re delighted to share the progress Post Office, together with Yoti, have made over the past year on our joint mission to build the UK’s trusted identity network. There’s been plenty to celebrate and some big milestones we’re very proud of. Over three million app installs 🎉 Over three million people in the UK have downloaded the EasyID and Yoti apps, showing that people want a more modern way to prove their identity. Our digital

Yoti and Post Office partner with PeopleCheck to power digital DBS checks

15th August 2022 – Today, Yoti and the Post Office announce they are the official provider of digital DBS checks for PeopleCheck, the UK’s leading background check provider for remote and onsite hires. As the UK’s first certified Identity Services Provider (IDSP), Yoti and the Post Office will deliver digital Right to Work and DBS checks, streamlining and speeding up the process for PeopleCheck. Historically, these checks had to be completed manually, with physical evidence and paper documents. But under new legislation, which came into effect on 6 April 2022, DBS and Right to Work checks can now be completed

Browse by category

Essential reading

Get up to speed on what kind of company we are