Digital ID for proof of age is coming. Here’s how to check it properly.

Millions of people are already using digital IDs to prove their age and identity, share their verified details with others or take more control over their personal data, all without needing a physical document. Soon, they’ll also be able to use them as proof of age when buying alcohol in licensed premises in the UK (once the mandatory licensing conditions are updated). This includes pubs, bars, restaurants, nightclubs and supermarkets. That’s a big shift in how age-restricted sales work and it’s why having a fast, reliable and low-friction way to check IDs matters for your business. How businesses

What are liveness checks and why do they matter?

A lot of life happens online now. You can open a bank account from your sofa. Start a new job without meeting anyone in person. Prove your age with a selfie. Interact on gaming platforms. Use a dating site. Rent a flat. Meet people you’ve never seen in real life. But all of these things only work if one thing is true: there’s a real person on the other side of the screen. When that assumption holds, things feel easy. When it doesn’t, people lose money, accounts get taken over, services grind to a halt and trust disappears fast.

Yoti helps platforms navigate Australia’s new social media age restrictions

Australia’s new age restriction laws for social media come into effect today, signalling a major shift in how online services must support age-appropriate access for younger users. As platforms prepare for increased regulatory scrutiny and tight compliance timelines, Yoti is enabling our social media partners to deploy trusted, privacy-preserving age assurance at scale. These reforms, led by the eSafety Commissioner, require major social media platforms to take ‘reasonable steps’ to stop under 16s from creating an account or using their services. There are no exceptions to this age limit, not even those with parental consent. The rules apply to

Give scammers the cold shoulder this Christmas with your Yoti Digital ID

The Christmas lights are glowing and the treats are flowing. But with all the festive fun comes a flurry of extra online shopping and last-minute plans. So it’s no surprise that scams, fraud, identity risks and in-person safety concerns tend to spike right alongside the mince pies. That’s where your Digital ID can come in. A trusted, privacy-friendly way to prove who you are (and check who others are) can make all the difference. Here’s how your Digital ID can help you keep things merry and bright this Christmas. Verify someone before you meet or trade Hunting for

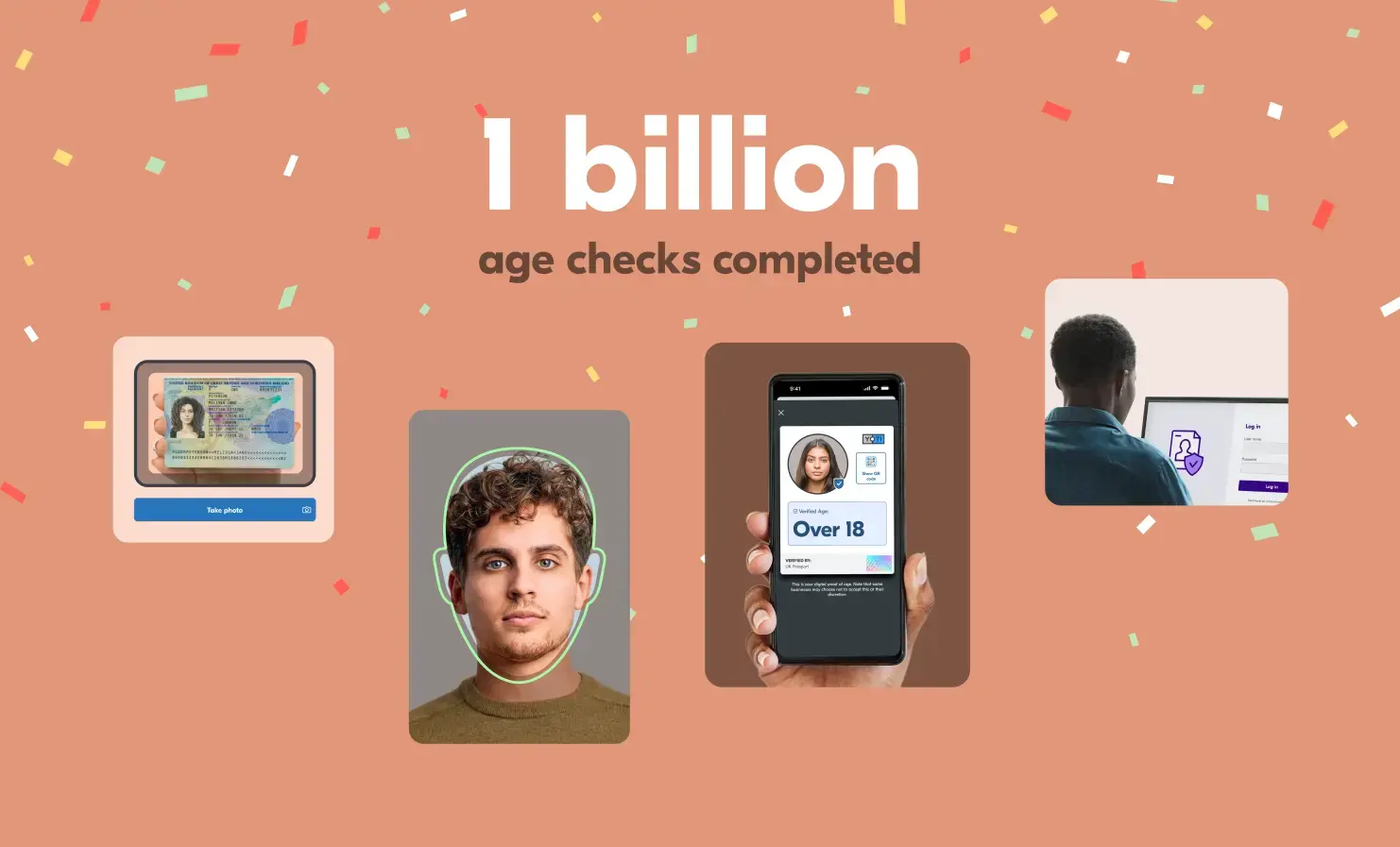

Yoti completes 1 billion age checks - and counting!

We’re celebrating a huge moment in our journey: Yoti has now completed over 1 billion age checks! When we started out, we had a simple but powerful ambition: to help people prove their age without revealing their full identity. We recognised early on that not everyone has access to a document or always feels comfortable using it. That’s why we innovated and developed facial age estimation. Reaching this milestone – across facial age estimation, Digital IDs, identity document checks and our other secure age-checking methods – shows that our technology is being used safely and responsibly around the

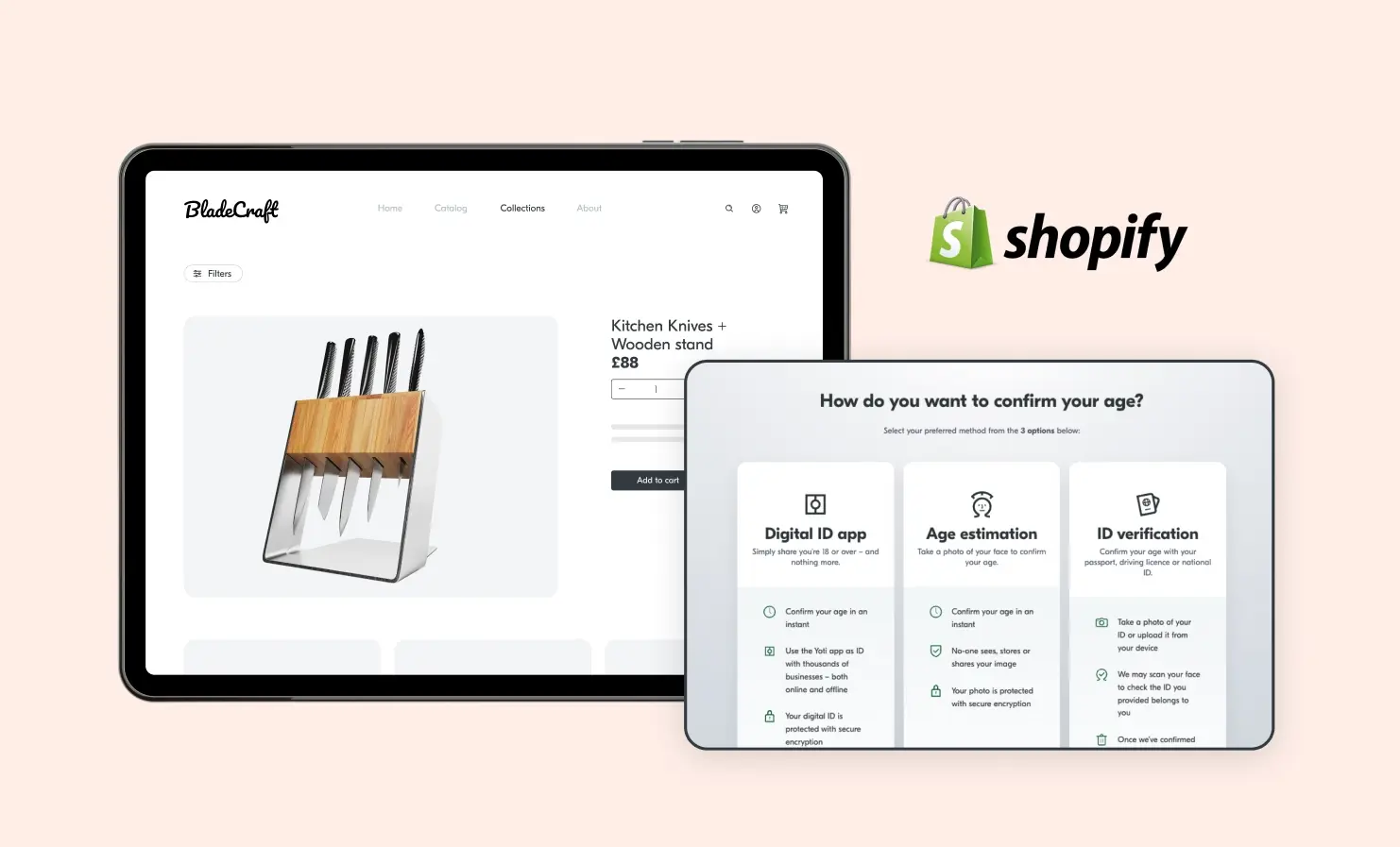

Yoti age checks now available for Shopify stores

If you sell age-restricted products on Shopify, we’ve got good news. It’s now easier than ever to add secure, seamless age checks to your online store. Yoti has now officially integrated with Shopify – one of the biggest ecommerce platforms in the world. That means Shopify merchants can now offer fast, privacy-preserving age checks for their customers. If you’re selling alcohol, vapes, knives or other age-restricted items, this integration helps you meet legal requirements without adding unnecessary friction to your customers’ journey. Why does this matter for Shopify merchants? Shopify powers millions of online businesses, including both independent