Identity Verification

Yoti’s identity verification service allows your customers to remotely prove who they are with just an identity document and selfie.

Get genuine customers through faster

No matter your company’s size, we’re here to make verifying customers more accessible for you. Our customisable identity verification tools give you the flexibility you need to deliver the perfect balance of speed and fraud detection at exactly the right time.

- KYC and AML in one tool

- 95% automation

- 24/7 human support

- No-code portal, SDK and API

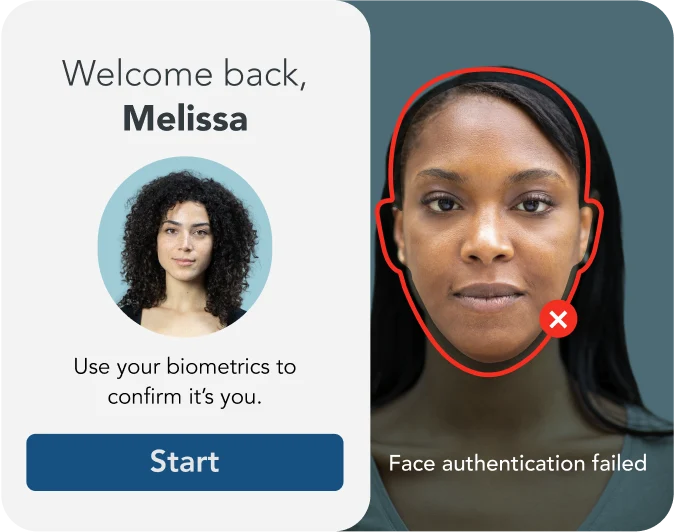

The identity verification process

Our simple UI makes identity verification a seamless process for your customers. Whether you’re after our core identity verification or additional checks for enhanced security, you can be confident only genuine customers are verified.

Enhance your identity verification with additional checks

Scale your solution across the globe

With our outstanding client support and industry-leading technology, we work with you to deliver the best identity verification experiences for your customers – wherever they are in the world.

We help you create the optimal balance of automation and manual verification to ensure you can handle spikes in volume and that document approval rates remain consistent, regardless of which country identity documents are from.

-

95% automation rate

Our AI-led verification process means you can onboard genuine customers quickly. Automated checks take approximately 5 seconds, while for Android and iOS users with ePassports, it’s instant.

-

200+ verification experts

Set risk levels for your automated checks, with our human specialists there to help you handle tricky submissions. Even for automated submissions, you can choose to have our team spot-check documents. Armed with the latest technology, they provide an additional defence against fraud.

More ways to verify customers with in-branch verification

Yoti and Post Office have joined forces to provide accessible and inclusive identity services, both online and in person.

Take advantage of Post Office’s branch network across the UK and give your customers a convenient way to prove their identity, powered by our verification technology.

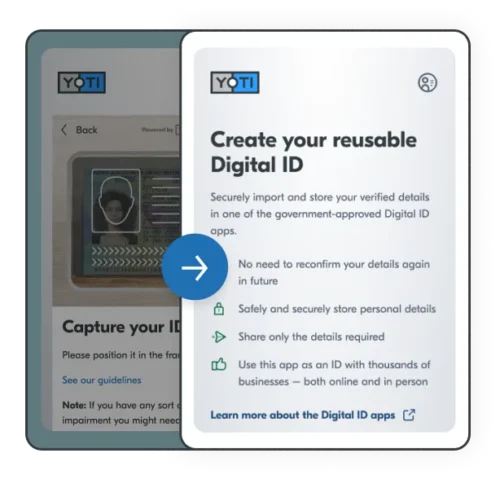

Accept identity verification from a Yoti ID

Give your customers another convenient and privacy-friendly way to prove who they are to your organisation, both online and in person.

With the Yoti ID app, customers only need to verify their identity details once to create a reusable Digital ID that they can use to instantly access your services.

Accreditations

Future-proof identity verification

With a single integration, Yoti IDV Plus lets your customers import the identity verification they complete on your website or app into their Yoti ID, Post Office EasyID or Lloyds Bank Smart ID.

When customers return to you, they can quickly and easily prove who they are using their Digital ID – creating a more seamless experience for your customers.

Choose the implementation that suits your business

No-code portal

Tailored to small and medium enterprises, the Yoti-hosted portal is suitable for low-volume checks, with no integration necessary. You can send your customers to a webpage to complete the identity verification process via a simple link, where you can manage all sessions in one place.

SDKs

Our document scanning and verification SDK can be integrated into your website, app or kiosk to provide a seamless customer experience. Customers scan their documents and complete verification directly within your existing flow.

Integrations

We offer 70+ integrations with the largest SaaS platforms to help you streamline the identity verification process within your existing workflows.

Why Yoti

The way we build our solutions is different to other tech companies. Yoti was founded on a strong set of principles that we uphold to ensure we continue to only build tech for good.

Proprietary tech

We provide world leading technology, developed in-house, to ensure higher success rates with customisable UX.

Build trust

We help businesses and people build trust with privacy-focused identity and age verification solutions. Over the past 10+ years, Yoti’s market-leading technology has transformed how people verify their details, empowering people with more control over their data.

Regulatory assurance

Our compliance team is across the latest global compliance frameworks and regulations to support you.

Security

Working with Yoti, you can be sure that your customers’ data is securely processed to meet the highest compliance standards.

Scalable globally

We have the capacity to scale to millions of checks per second across 200+ countries and territories. We accept 5,500+ documents in 20 languages.

More choice

Yoti offers the most comprehensive suite of identity verification solutions in the market, with automation and human fallback working alongside each other for high assurance.

Continuous improvement

We hold many of our own patents and are constantly evolving our products and features to meet the changing needs of customers – at no cost to them.

Complete protection against fraud

Yoti serves as your vigilant guardian, offering more than customer verification. Our suite of best-in-class identity and age verification tools protect your business from threats of deepfake and generative AI fraud.

Contact us

Find out how Yoti makes compliance simple

Fill out this form and our sales team will be in touch to find a solution that works for you.

Not a business? Visit our consumer help centre for help using our products.