Yoti blog

Stories and insights from the world of digital identity

Thoughts from our CEO

The BritCard debate heats up as digital ID adoption grows Just a few months after the UK Government introduced a voluntary digital ID wallet, some influential voices within Labour are already pushing to make it mandatory. They’ve also suggested rebranding it as the ‘BritCard app’ or ‘BritCard digital ID wallet’. In the 2 years between late 2025 and late 2027, I believe many (potentially a majority) of the UK’s 57 million adults will get a UK Government digital ID wallet. From late 2025, users will be able to access their mobile driving licence details. By the end of

The Supreme Court rules in favour of age verification

The question of whether states can require age checks on adult websites has reached a turning point in the US courts. In Free Speech Coalition v. Paxton, the case challenged Texas’s H.B. 1181 law, which required commercial websites that publish sexually explicit content to verify the ages of their visitors to prevent minors from accessing pornography. One of the big discussion points has been whether, in 2025, it is still too burdensome for US adults to prove age privately compared to 20 years ago – especially when privacy-preserving age verification tools have advanced significantly. The Supreme Court has upheld

Ireland’s Online Safety Code: what it means for online platforms and how to comply

What you need to know: Ireland’s Online Safety Code will hold video-sharing platforms accountable for keeping their users, especially children, safe online. Platforms with adult content, including pornographic or extremely violent content, must use age assurance to prevent children from accessing the content. These age assurance requirements come into force in July 2025. Platforms that don’t comply can face strong penalties – up to €20 million or 10% of annual turnover. From July 2025, video-sharing platforms in Ireland with pornography or extremely violent content will need to introduce age assurance to protect children from accessing their content.

Understanding the UK’s new Data Act

The Data (Use and Access) Act, now known more simply as the “Data Act”, is a landmark piece of UK legislation that aims to reshape how individuals and businesses interact with digital data. It introduces provisions for a national digital identity trust framework, helping to foster trust in digital identities by ensuring that businesses adhere to strict standards during digital transactions. This blog gives an overview of the Data Act and what this means for digital identities in the UK. Why has the Government introduced the Data Act? The Government has said that the Act will “unlock the

Why early detection is critical in stopping deepfake attacks

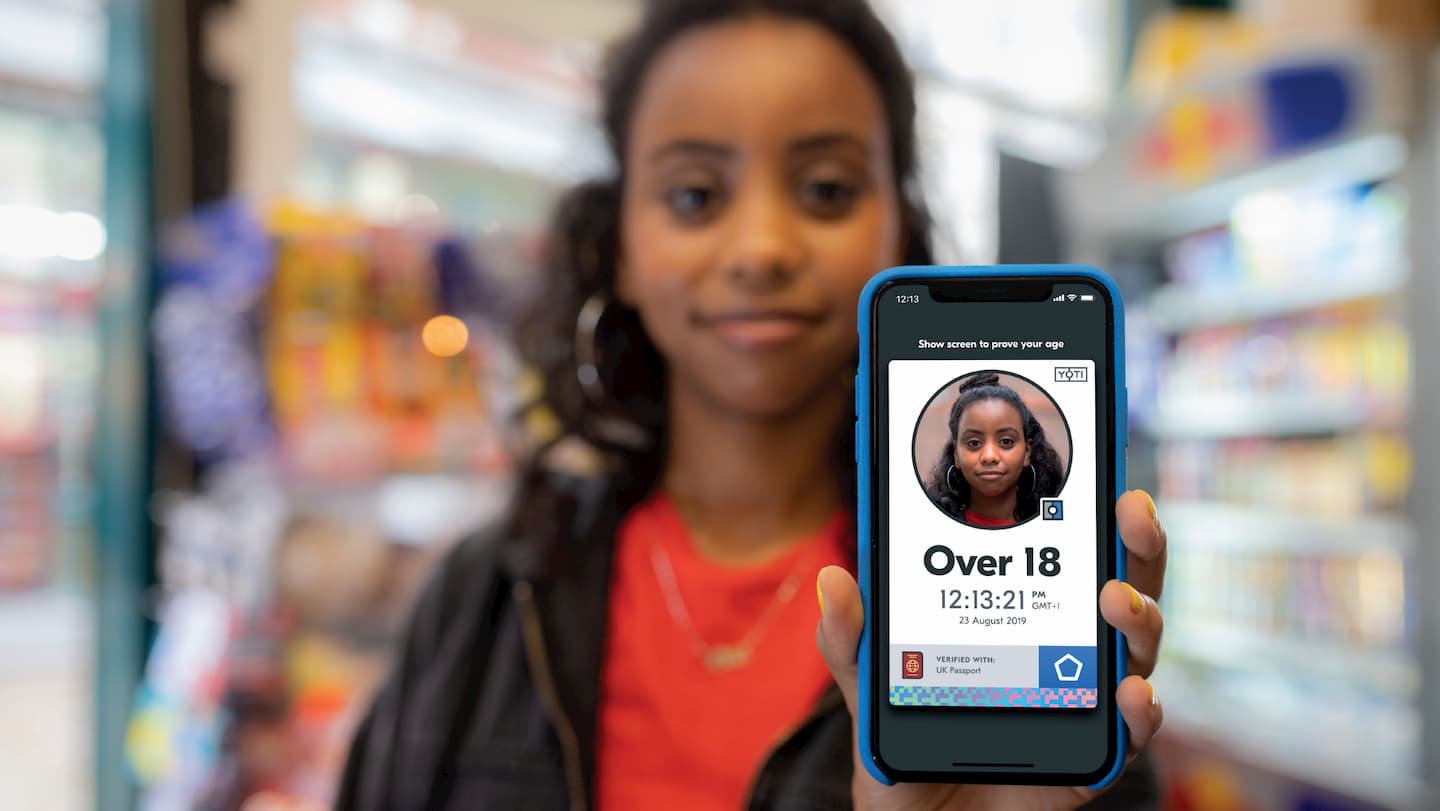

Digital identity and age verification are becoming integral parts of customer onboarding and access management, allowing customers to get up and running on your platform fast. However as customer verification tools become more advanced, so too are fraudsters seeking to spoof systems by impersonating someone, appearing older than they really are or passing as a real person when they’re not. Deepfake attacks, which can mimic a person’s face, voice or mannerisms, pose a serious threat to any business using biometric customer verification. In this blog, we explore why detecting deepfakes early is essential for maintaining trust, security and regulatory

Understanding age assurance in Spain's new online safety law

As digital technology continues to shape how people interact, communicate and consume content, protecting children online has become an increasingly urgent issue. Recognising this, the Spanish government has proposed the Organic Law for the Protection of Minors in Digital Environments. The law is now in its final stages of approval. While comparable initiatives such as the UK’s Online Safety Act and California’s Age-Appropriate Design Code exist in other jurisdictions, the Spanish law stands out for its broad scope and emphasis on enforceable age assurance, platform accountability and digital literacy. Its comprehensive framework places it among the leading examples of

Browse by category

Essential reading

Get up to speed on what kind of company we are