The Age Appropriate Design Code for businesses

This blog was updated in February 2024, following the ICO’s updated opinion on age assurance for the Children’s Code. In a nutshell the main changes include: Facial age estimation is now recognised as the most widely used age estimation approach, with high levels of accuracy. Self-declaration on its own is not sufficient for high-risk services. The ICO has also introduced a new term, the ‘waterfall technique’. This refers to a combination of age assurance methods. Companies should ensure that any age assurance system implemented has an appropriate level of technical accuracy, reliability and robustness, whilst operating in a fair

What’s in store for 2024

As we get our heads back into work after the festive break, our team has shared their predictions for 2024. The threat from deepfakes will accelerate In 2023, the threat of AI generated deepfakes continued to make the headlines. Some celebrities and well-known public figures found a fake advert of them promoting special offers or investments. News stories reported scammers using AI to mimic the voice of a loved one or to pretend to be someone from their bank. And technology was used to create AI-generated child sexual abuse images. With over 70 countries hosting general elections in 2024,

Yoti selects ROC.ai’s facial recognition software to enhance identity verification solutions

13th December 2023, London, UK – Yoti is delighted to announce it will start using ROC.ai’s world-class facial recognition software across its suite of ID platform services. A progressive, innovative leader in AI-powered computer vision and biometrics, ROC.ai’s facial recognition algorithms have been independently tested by the US National Institute for Standards and Technology (NIST). Their solutions are trusted by the US Department of Defence, federal and state law enforcement agencies, and some of the world’s leading financial institutions. ROC.ai is committed to delivering technology that respects privacy and works for all races, ages and genders. This is outlined in

Exploring bias in credit card-based age verification

We publish the accuracy rates of our facial age estimation technology, split by gender, age and skin tone. By being open and transparent, we hope to give businesses and users confidence in the technology. We also hope this helps regulators to fairly review facial age estimation as an effective age assurance method. However whilst evaluating facial age estimation, some stakeholders and regulators overlook the drawbacks and bias shown in other age assurance approaches. Bias and limitations of using credit cards for age verification One age check method approved in many countries is asking adults to use a credit card

Asking the FTC to approve facial age estimation for verifiable parental consent

Together with the Privacy Certified program of the Entertainment Software Rating Board (ESRB) and Kids Web Services Ltd, a wholly owned Epic Games subsidiary, we are asking the Federal Trade Commission (FTC) for approval to implement facial age estimation as an authorised method for verifiable parental consent (VPC). The Children’s Online Privacy Protection Act (COPPA) requires companies to ensure they are not collecting personal data from children under the age of 13 without a parent’s consent. Currently, the COPPA Rule enumerates seven, non-exhaustive methods that enable parents to verify their consent. These include verification by government ID, credit card

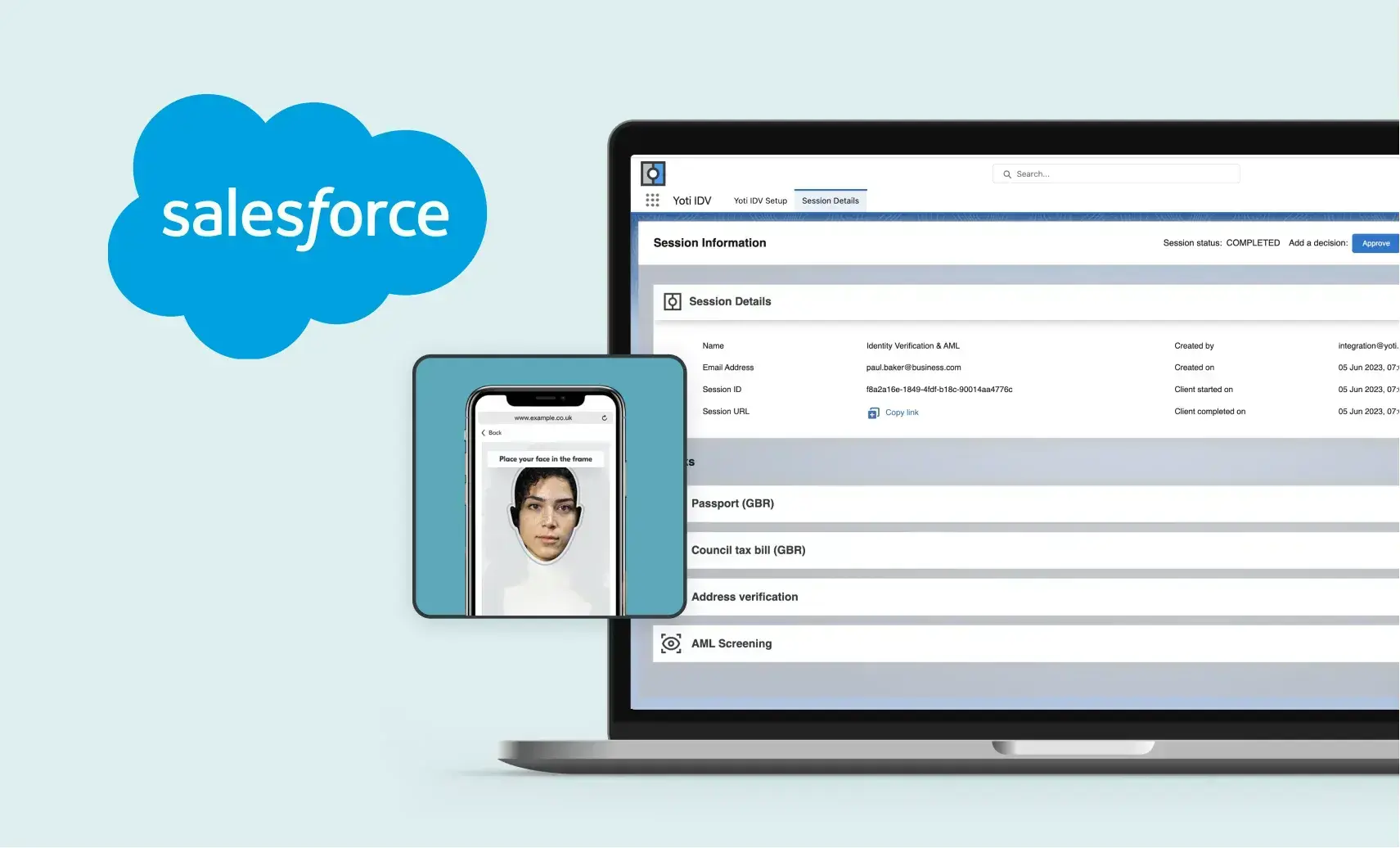

Yoti identity verification checks now on Salesforce AppExchange

No matter your company’s size, we’re here to make verifying customers more accessible, easy and secure for you. With this in mind, we’re pleased to now offer our identity verification technology on the Salesforce AppExchange – the leading enterprise marketplace with ready-to-install apps and solutions. It’s a ready-made solution and allows you to quickly and securely verify the identity of your customers. Armed with our ID verification, you can increase automation, fight fraud, reduce risk and stay compliant. Start an identity check and receive the results – all in your Salesforce dashboard. This removes the need to see or store