Together with the Privacy Certified program of the Entertainment Software Rating Board (ESRB) and Kids Web Services Ltd, a wholly owned Epic Games subsidiary, we are asking the Federal Trade Commission (FTC) for approval to implement facial age estimation as an authorised method for verifiable parental consent (VPC). The Children’s Online Privacy Protection Act (COPPA) requires companies to ensure they are not collecting personal data from children under the age of 13 without a parent’s consent. Currently, the COPPA Rule enumerates seven, non-exhaustive methods that enable parents to verify their consent. These include verification by government ID, credit card transaction, and a method that involves facial recognition, which is different from what we propose in our application.

We’d like the FTC to authorise facial age estimation as another VPC method to give parents and operators more choice in how parents can prove their age and grant consent. We are not seeking approval to implement this technology to check if children are old enough to purchase, download, and/or play a video game. Children are not involved in the age estimation process at all, which is designed to confirm that parents are adults, as required under COPPA.

We’d like to explain how the FTC application seeks to implement the technology in a way that is consistent with COPPA’s requirements for data minimisation, confidentiality and security.

- Facial age estimation provides an accurate, reliable, accessible, fast, simple and privacy-preserving method to ensure that the person providing consent is an adult.

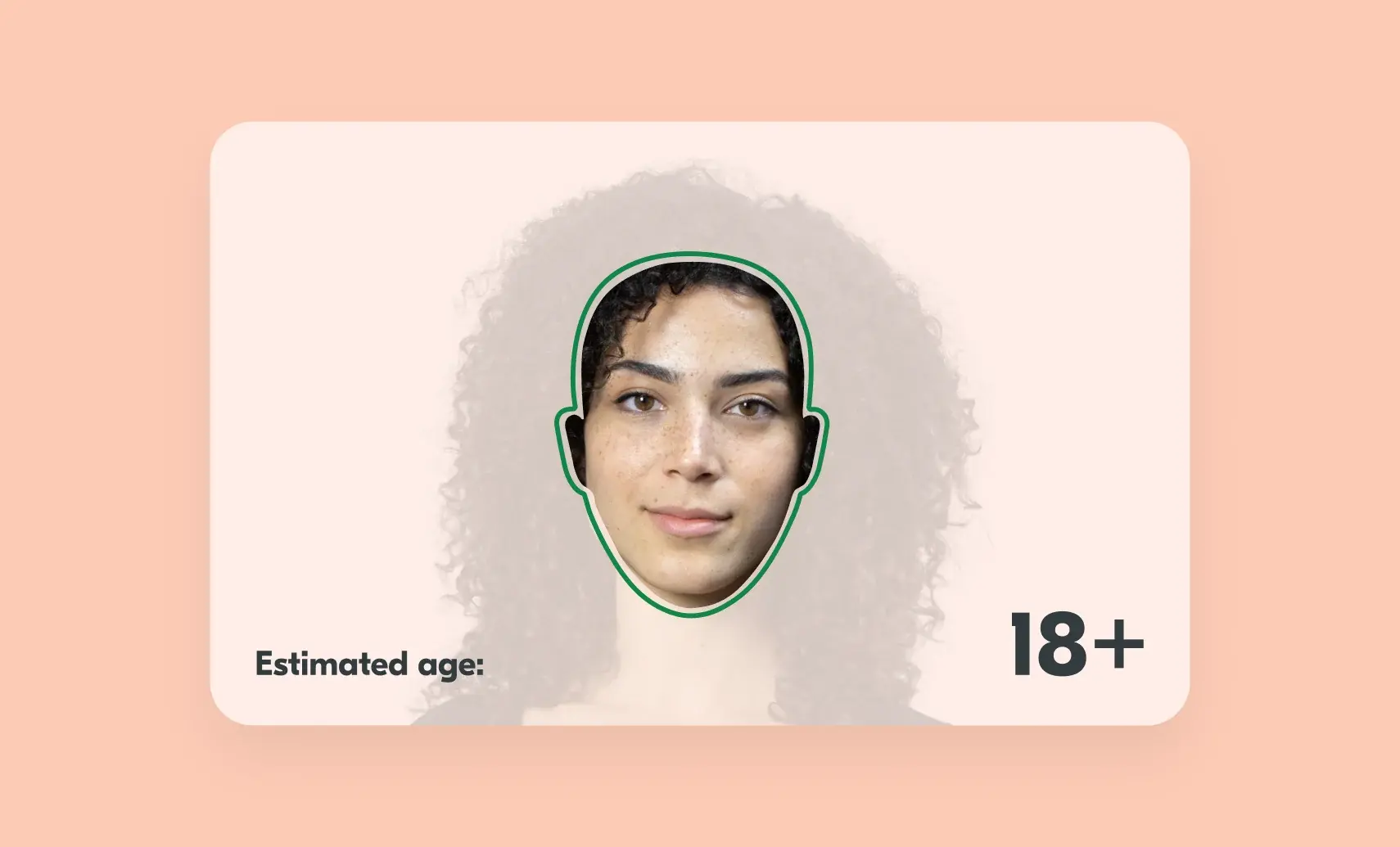

- Facial age estimation is not facial recognition; it estimates a parent’s age without identifying them. It does so by converting the pixels of a facial image into numbers and comparing the pattern of numbers to patterns associated with known ages.

- Facial age estimation does not create a database of faces. It doesn’t learn the user’s name, identity or anything about them. It does not scan their face against a database.

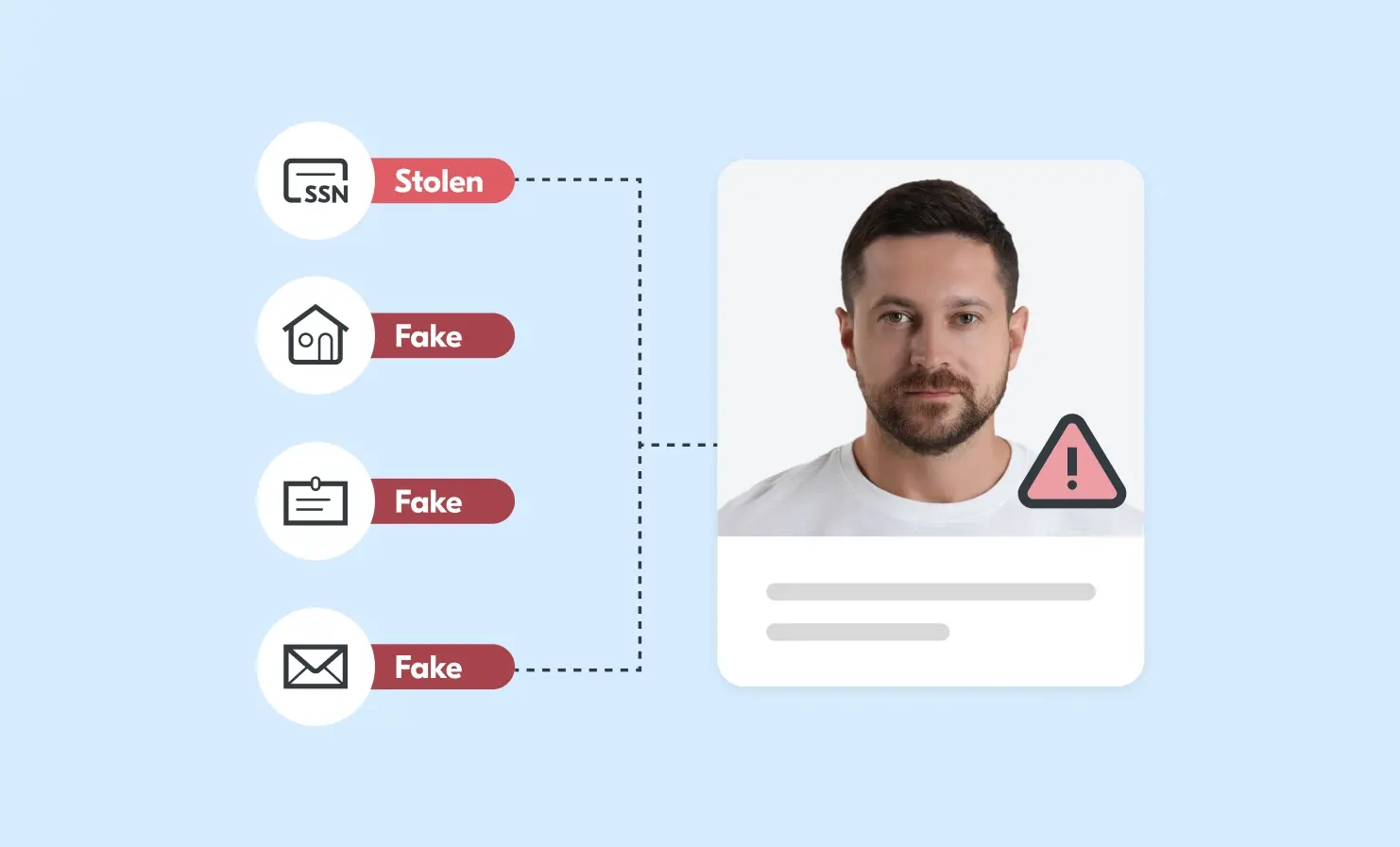

- The technology is inclusive; it requires no collection of identity or payment card information.

- It is accurate and does not show material bias among people of different skin tones. We have done extensive testing based on millions of facial scans and publish the accuracy levels transparently.

- In our proposed application, facial age estimation is always presented as an option to parents alongside other approved methods of verification, providing the parent with a choice of methods.

If you have any questions about our FTC application, please get in touch.