- This follows the £10 million Lloyds Banking Group invested in Yoti to support the development of a new, reusable digital identity proposition

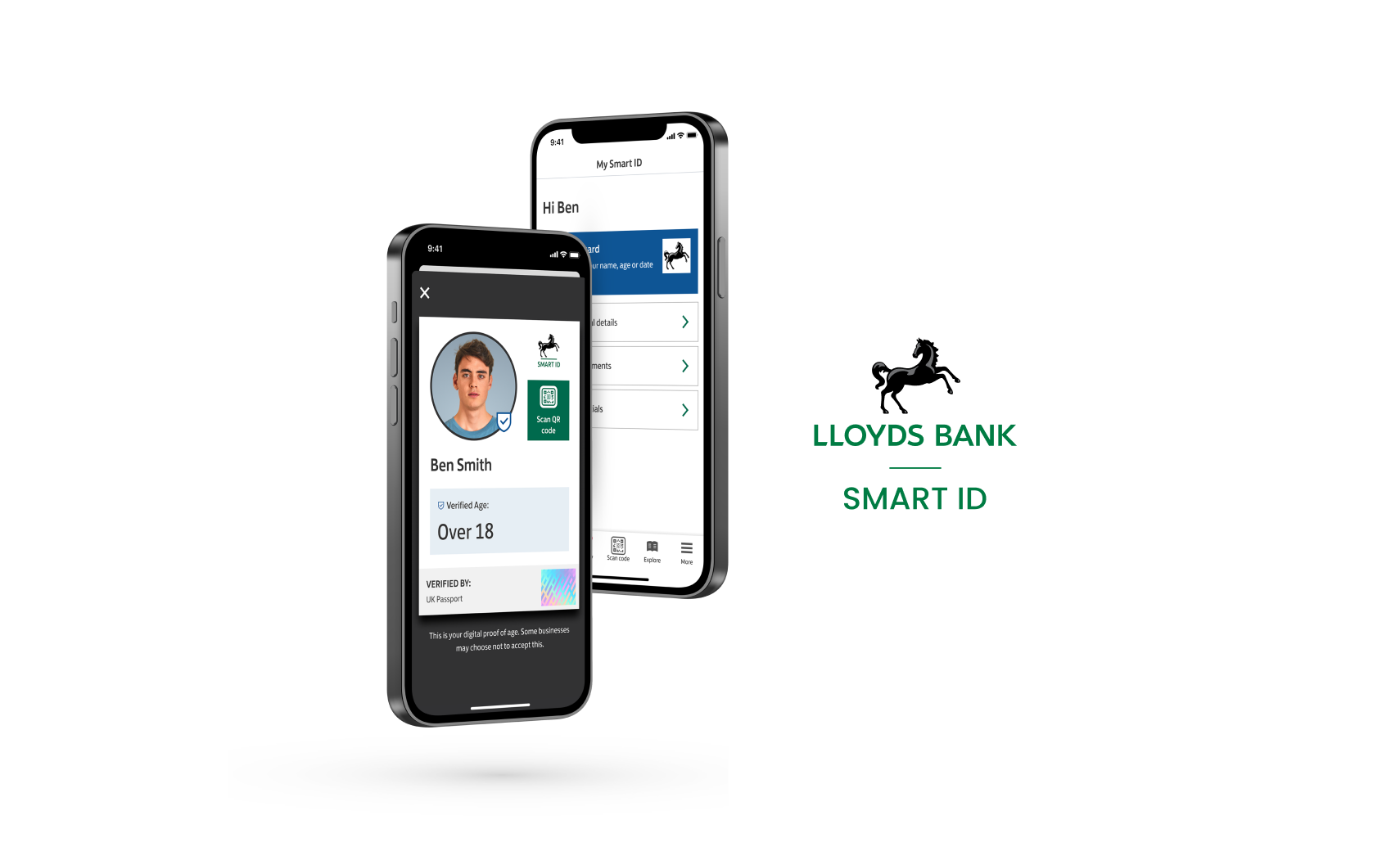

London, UK, 2nd October 2023: Yoti has released a new Digital ID app with Lloyds Bank – Lloyds Bank Smart ID. The app gives people a more private, secure and convenient way to prove their age or identity from their phone.

This follows the £10 million investment Lloyds Banking Group made in Yoti earlier this year. The investment supported the development of a new, reusable digital identity app to help combat the growing risks of identity fraud, which is one of the biggest fraud threats to the UK public.

Lloyds Bank Smart ID is a reusable Digital ID which transforms the way people prove their age and identity. It allows people to share specific information with businesses who request it – such as name, date of birth or an ‘over 18’ proof of age – without having to show physical identity documents or share an excessive amount of personal data.

The app is built using Yoti’s technology, which is certified to meet the highest security and privacy standards, including ISO 27001 and 27701, and SOC2 Type II. The free app is available to UK residents.

Yoti has already launched a number of successful Digital ID apps. In the UK, the Yoti ID and Post Office EasyID apps are already accepted to pick up parcels at the Post Office and as proof of age at cinemas and convenience stores (excluding alcohol sales). Last year, they were also certified by the UK government as proof of identity for right to work, right to rent and criminal record checks.

Yoti, Lloyds Bank and Post Office are committed to bringing Digital ID to as many people in the UK as possible. The introduction of Lloyds Bank Smart ID gives more people the opportunity to create a secure, reusable Digital ID.

Businesses that accept Yoti ID and EasyID can now accept Lloyds Bank Smart ID, which is available in the app stores. The three Digital ID apps are interoperable, so they can be used in all the same places. Together, Lloyds Bank Smart ID, Yoti ID and Post Office EasyID form ‘Digital ID Connect’, the UK’s largest network of reusable Digital ID apps with over four million downloads already.

The three companies will announce new ways people can use their Digital ID apps over the coming months.

James Fulker, Chief Digital Officer at Lloyds Banking Group said, “Lloyds Bank Smart ID means UK consumers now have further access to secure, digital ways of proving their identity and it marks a significant milestone following our investment in Yoti. We look forward to our continued work developing this proposition with Yoti.”

Robin Tombs, CEO at Yoti said, “Built using our leading identity verification technology, Lloyds Bank Smart ID will make it easier and safer for more people in the UK to prove who they are. Digital IDs transform the way we share our personal data, allowing us to only share the information a business needs, rather than showing a full identity document. Digital IDs can reduce identity theft, increase the security of our personal data, and create more trust between people and businesses. I’m delighted to have the UK’s largest bank accelerate the network of reusable Digital ID apps so even more people have the opportunity to take control of their digital identities.’

Elinor Hull, Post Office Identity Services Director said, “We’re delighted that our partner Yoti has released a Digital ID app with Lloyds Bank. This will help ensure more people have confidence when it comes to sharing their personal data and together as leaders in the industry we will be increasing the use of Digital ID throughout the UK.”

The reusable Digital ID market is expected to be worth $266 billion by 2027 as more services move online, regulation evolves to accept Digital IDs, and individuals demand more privacy-preserving solutions.

There are over four million downloads of the Yoti ID and Easy ID apps in the UK.

Lloyds Bank Smart ID is available to download from the Apple and Android stores.

Notes to editors:

In 2021, Yoti partnered with Post Office to bring together a world-leading suite of online and in-person identity verification solutions to the UK market. This includes the Post Office EasyID app.

In 2023, Lloyds Banking Group invested £10 million in Yoti. The investment supported the development of Lloyds Bank Smart ID.

About Yoti

Yoti is a digital identity technology company that makes it safer for people to prove who they are, verifying identities and trusted credentials online and in-person. They now provide verification solutions across the globe, spanning identity verification, age verification, document eSigning, access management, and authentication and leading facial age estimation. Over 13 million people have downloaded the free Yoti Digital ID app across the world. It is available in English, Spanish, French, German, Portuguese and Polish. Yoti is certified to ISO/IEC 27001:2013 for ID Verification Services, ISO 27701 for data privacy, and SAE 3000 (SOC 2) Type 2 certified for its technical and organisational security processes. For more information, please visit www.yoti.com.

About Lloyds Banking Group

Lloyds Banking Group is the largest UK retail and commercial financial services provider with around 26 million customers and a presence in nearly every community. Our main business activities include retail and commercial banking, general insurance, and long-term savings, provided through well recognised brands including Lloyds Bank, Halifax, Bank of Scotland, Scottish Widows.

Our purpose is helping Britain prosper. We have served Britain through our products and services for more than 320 years, across every community and millions of households. Our success is interwoven with the UK’s prosperity, and we aim to help Britain prosper by operating as a responsible, sustainable, and inclusive Group.