- Investment will be used to develop innovative technology that protects customers’ identities and personal data online

- Lloyds Banking Group will support Yoti in developing a new, reusable digital identity proposition that will help combat the growing risks of identity fraud

Lloyds Banking Group has invested £10 million in digital identity company Yoti, an investment which supports the development of innovative technology to keep people safe online, tackle the ever-growing risks of identity fraud, and give people more control over their personal data.

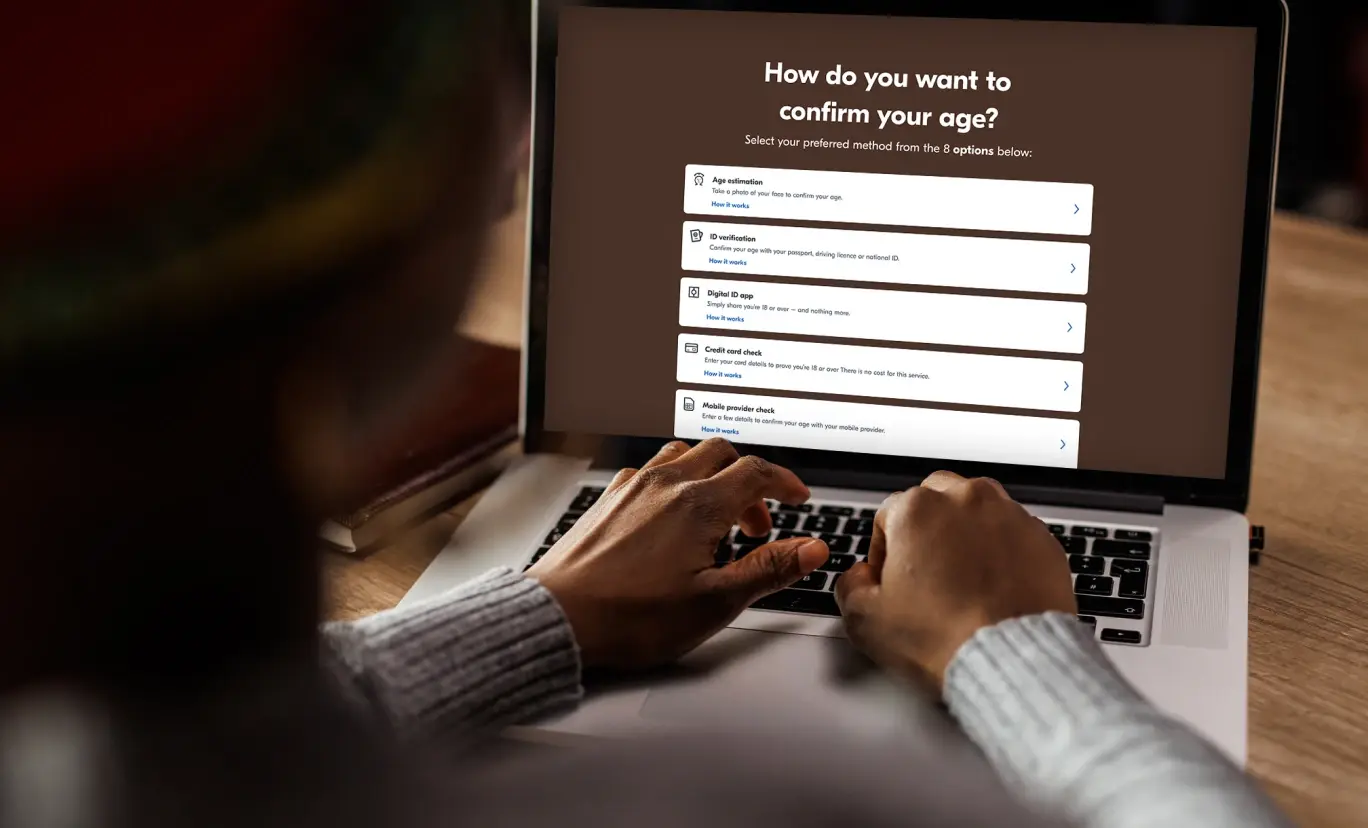

Yoti offer a range of digital identity solutions that make it simple for people and businesses to protect themselves online. This includes a free Digital ID app, which gives individuals a safe and instant way to prove their identity from their phone, with no need to show ID documents or share an excessive amount of personal data. Digital IDs are a UK government-approved form of identification for right to work, right to rent and criminal records checks. Yoti’s Digital ID is also accepted as proof of age at UK cinemas,and for the sale of lottery tickets, energy drinks and tobacco. Businesses across a range of industries – from financial services and retail to gaming and e-commerce – are already seeing the benefits of Digital ID services.

The investment from Lloyds Banking Group will support Yoti’s development of a new reusable digital identity proposition that will complement Yoti’s existing solutions. Set to launch later this year, this will give users a more private, secure and convenient way to prove their identity.

Kirsty Rutter, FinTech Investment Director at Lloyds Banking Group, said: “We are thrilled to be supporting Yoti and their experienced, passionate team with their work to further protect people online, through developing and growing digital identity solutions.

“We know how important fintechs and technology partners are for delivering better outcomes for our customers and this investment represents another step forward in our plans to strengthen the UK’s financial ecosystem and is a crucial part of how we help Britain prosper.”

Robin Tombs, CEO at Yoti said, “I’m delighted to announce Lloyds Banking Group’s significant investment in Yoti. The combination of their expertise in financial services and our digital identity solutions will bring security to even more businesses, people and communities. We will make it easier and safer for individuals to prove who they are and enable businesses to have more trust and confidence in the identity of their customers.”

The investment in Yoti is Lloyds Banking Group’s second investment of 2023, following a successful round of investments in 2022. These investments are headed up by the Group’s recently formed Fintech Investment team, which focuses on identifying and exploring opportunities for investment into fintech at Seed to Series B.

Notes to editors

With a reusable digital identity, individuals only need to verify their identity once and then share verified details in seconds, without needing to show their ID documents each time. Individuals can just share the details they need and nothing else – giving them greater control over their personal data. With individuals pre-verified, organisations can have greater confidence and trust in who they are dealing with.

About Lloyds Banking Group

Lloyds Banking Group is the largest UK retail and commercial financial services provider with around 26 million customers and a presence in nearly every community. Our main business activities include retail and commercial banking, general insurance, and long-term savings, provided through well recognised brands including Lloyds Bank, Halifax, Bank of Scotland, Scottish Widows.

Our purpose is helping Britain prosper. We have served Britain through our products and services for more than 320 years, across every community and millions of households. Our success is interwoven with the UK’s prosperity, and we aim to help Britain prosper by operating as a responsible, sustainable, and inclusive Group.

About Yoti

Yoti is a digital identity technology company that makes it safer for people to prove who they are, verifying identities and trusted credentials online and in-person. They now provide verification solutions across the globe, spanning identity verification, age verification, document eSigning, access management, and authentication and leading facial age estimation. Over 13 million people have downloaded the free Yoti Digital ID app across the world. It is available in English, Spanish, French, German, Portuguese and Polish. Yoti is certified to ISO/IEC 27001:2013 for ID Verification Services, ISAE 3000 (SOC 2) Type 2 certified for its technical and organisational security processes. For more information, please visit www.yoti.com.