Articles

Age assurance: the facts

Around the world, regulators are introducing online safety and age checking laws to protect minors online. But some people believe that age assurance can’t be done without risking our privacy. In reality, the challenge of checking someone’s age online in a privacy-preserving way has been solved. In this paper, we address some of the common concerns around age assurance. Read the facts

How accurate can facial age estimation get?

Facial age estimation using machine learning has advanced significantly in recent years. But, a common and fair question still arises: How accurate can it really be? Can a system look at your face and accurately guess your age, especially when humans often get it wrong? The short answer is that it’s very accurate – but not perfect. We explain why. The myth of 100% accuracy It’s important to set realistic expectations. No facial age estimation model can achieve 100% accuracy across all ages. Human aging is highly individual and shaped by many external factors, especially as we get

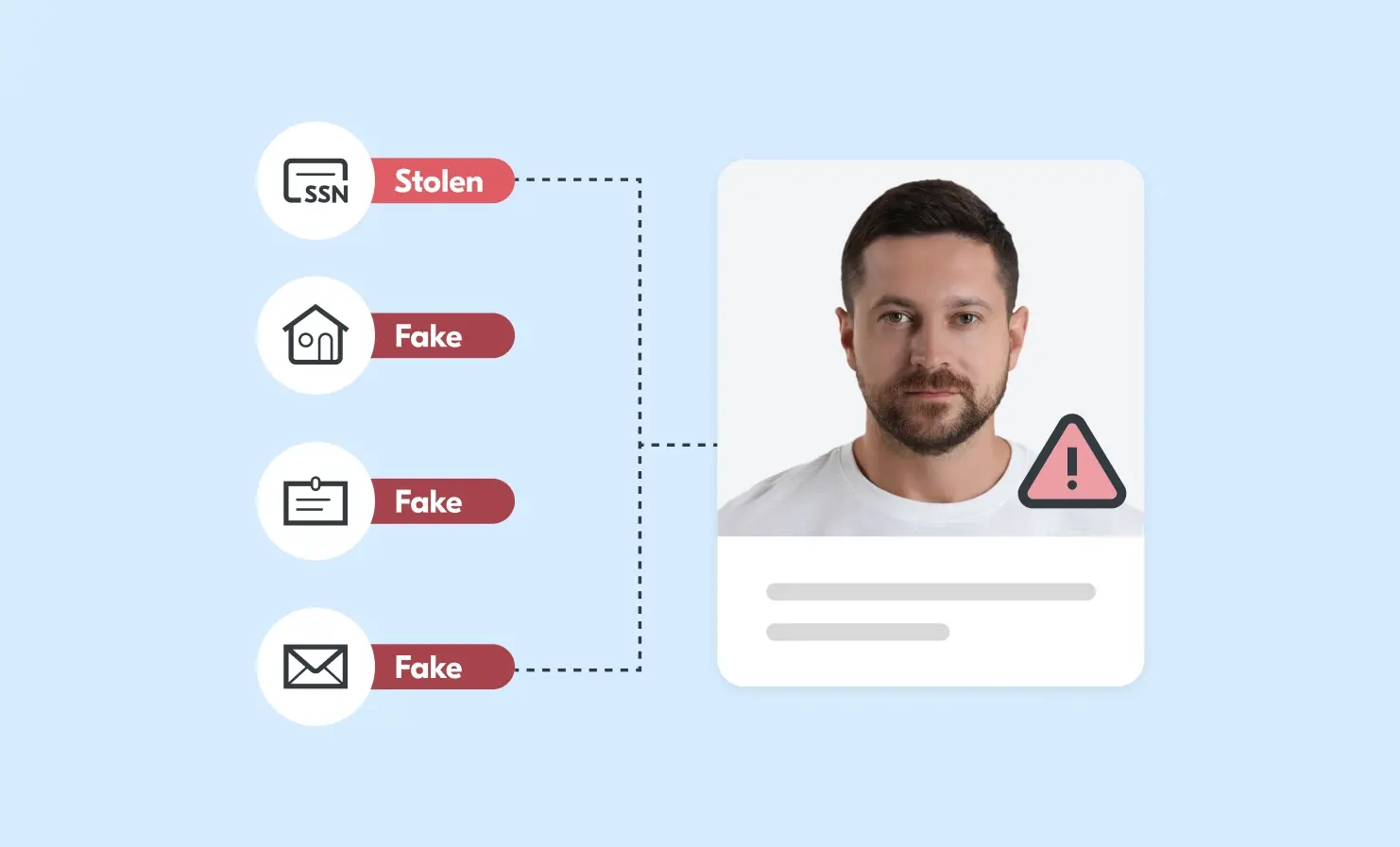

What is synthetic identity fraud? How it works and how to prevent it

What is synthetic identity fraud? Synthetic identities are fake identities, built by combining real and made-up information, earning them the nickname “Frankenstein IDs” due to their pieced-together nature. Synthetic identity fraud is different to traditional identity fraud as it doesn’t involve an obvious, immediate consumer victim. These fake profiles are designed to mimic real customers, often slipping past traditional fraud detection systems because they don’t raise typical red flags. As a result, the primary victims of synthetic identity fraud are businesses and lenders, who bear the financial losses. How synthetic identities are created and used

Thoughts from our CEO

The BritCard debate heats up as digital ID adoption grows Just a few months after the UK Government introduced a voluntary digital ID wallet, some influential voices within Labour are already pushing to make it mandatory. They’ve also suggested rebranding it as the ‘BritCard app’ or ‘BritCard digital ID wallet’. In the 2 years between late 2025 and late 2027, I believe many (potentially a majority) of the UK’s 57 million adults will get a UK Government digital ID wallet. From late 2025, users will be able to access their mobile driving licence details. By the end of

The Supreme Court rules in favour of age verification

The question of whether states can require age checks on adult websites has reached a turning point in the US courts. In Free Speech Coalition v. Paxton, the case challenged Texas’s H.B. 1181 law, which required commercial websites that publish sexually explicit content to verify the ages of their visitors to prevent minors from accessing pornography. One of the big discussion points has been whether, in 2025, it is still too burdensome for US adults to prove age privately compared to 20 years ago – especially when privacy-preserving age verification tools have advanced significantly. The Supreme Court has upheld

Ireland’s Online Safety Code: what it means for online platforms and how to comply

What you need to know: Ireland’s Online Safety Code will hold video-sharing platforms accountable for keeping their users, especially children, safe online. Platforms with adult content, including pornographic or extremely violent content, must use age assurance to prevent children from accessing the content. These age assurance requirements come into force in July 2025. Platforms that don’t comply can face strong penalties – up to €20 million or 10% of annual turnover. From July 2025, video-sharing platforms in Ireland with pornography or extremely violent content will need to introduce age assurance to protect children from accessing their content.