This blog post was updated in March 2025 with new and updated regulations. It also clarifies that the Digital ID age checks are free to businesses, when they are used alongside other Yoti age verification solutions.

*****

With so much of our lives spent online – we can chat to friends, watch our favourite shows, and expand our learning – it’s so important to make sure children are only accessing age-appropriate content.

A wave of regulations around the world are aiming to create safer online environments. In the UK, the Age Appropriate Design Code (the ‘AADC’, also called the Children’s Code) aims to protect children’s data and give them high levels of privacy protection by default. The UK Online Safety Act, coming into force in 2025, aims to create a safer online world and protect people from online harms and risks.

In the US, California has its own version of the AADC and an increasing number of US regulators are also bringing in legislation which requires social media and adult platforms to verify the age of users. Louisiana was the first to introduce age verification and we’ve seen several states follow suit, including Utah, Arkansas, Mississippi, Virginia, Arizona and Texas.

The Digital Markets & Digital Services Acts have been passed in the EU, and in Australia, the Government is introducing minimum age limits for social media in 2025.

When it comes to age verification, this should be done in a way that protects people’s privacy. We don’t think people should have to share their identity or lots of personal data. They just need to prove their age.

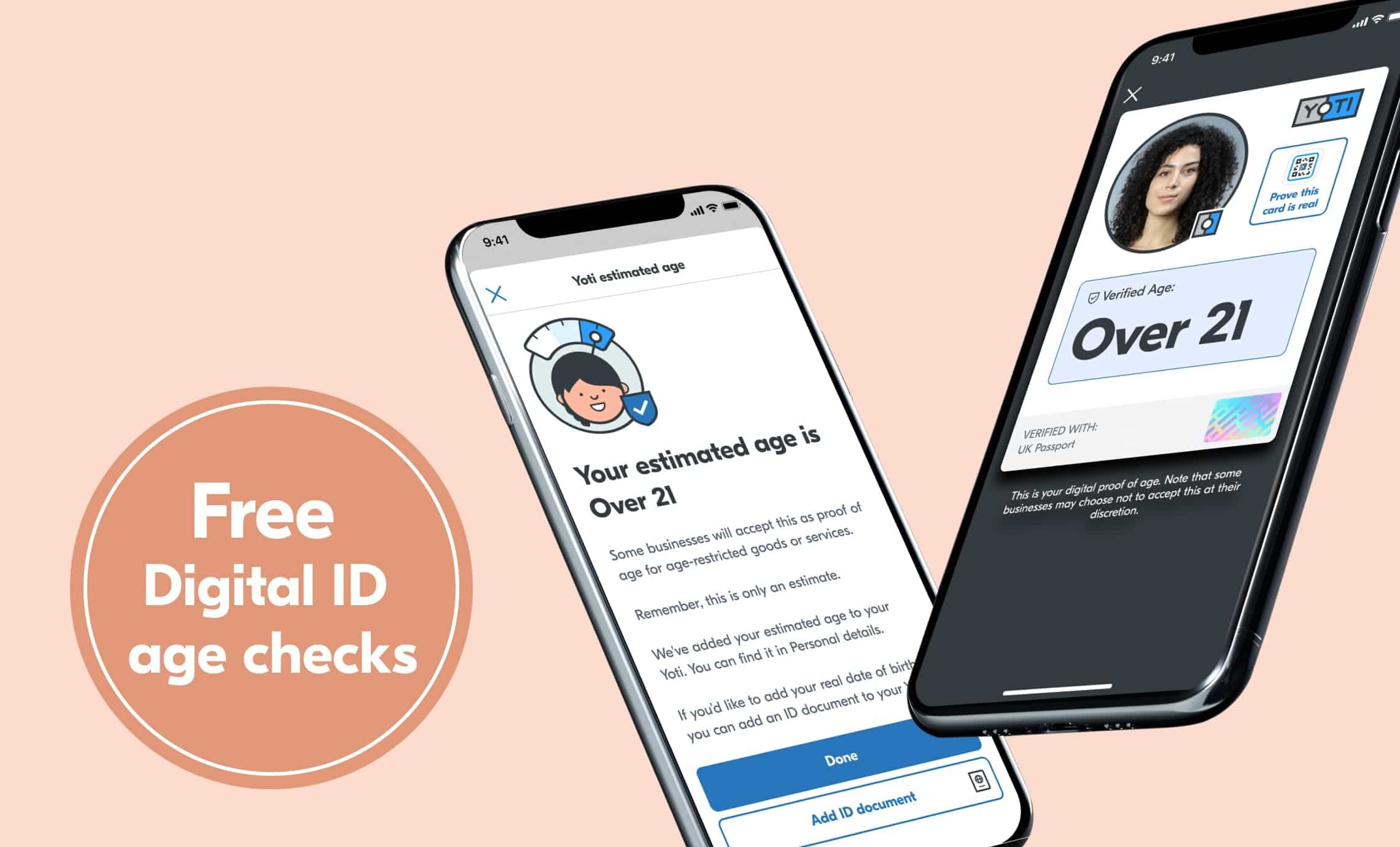

To ensure privacy-preserving technology is accessible to all globally, we are offering age checks through our Digital ID app for free to any business, when used alongside our other age verification products. This reduces cost barriers businesses might face when verifying the age of users.

The challenges of checking age online

Age verification is something we are all very familiar with. Whether we’re buying a bottle of wine, watching a horror film or going to a nightclub, there are clear protections in place to prevent children from accessing age-restricted goods and services.

But when it comes to checking age online, these protections are seriously lacking. Historically, online age verification has involved entering a date of birth or checking an ‘Over 18’ tickbox. But these are often ineffective as it’s very easy for someone to lie about their date of birth or tick a box.

Because these methods are easily bypassed, some people think the only way to effectively check age online is with an identity document, mobile phone number or credit card. But this is an outdated view, and simply isn’t true.

Asking people to use one of these methods is not always the best option. A child could easily ‘borrow’ their parent’s credit card or enter their mobile phone number. Sharing an identity document each time you access a website creates a poor user experience and not everyone feels comfortable sharing all of this information online. And in many countries, database checks to electoral rolls are not sufficiently accurate as not all adults are included on such databases.

Asking people to use identity documents can also exclude many; over one billion people around the world do not own or have access to an ID. This is particularly true for the most vulnerable people in society.

A privacy-preserving approach to age assurance

We believe legislators should look further than ID verification and recognise effective methods that protect people’s privacy. People should just be able to share their age, without also sharing their name, address or other personal details. This is exactly what our Digital ID empowers people to do. It’s a new approach to age assurance which is better for everyone, and we’re proud to lead the way in privacy-preserving age checks.

With Digital ID apps, like Yoti (and Post Office EasyID and Lloyds Bank Smart ID in the UK), people only have to verify their details once. They can then use the app as proof of age, without sharing any other personal information. This ‘data minimisation’ approach is better for everyone; it’s more private for individuals and gives businesses the details they need to comply with regulations. They do not need to ask for, or store, sensitive personal information.

An increasing number of businesses and regulators see the value in a reusable digital ID. In 2022, the UK government certified digital IDs for right to work, DBS and right to rent checks. The UK Cinema Association, representing the interests of the vast majority of UK cinemas, accepts the Yoti, Post Office EasyID and Lloyds Bank Smart ID apps as proof of age. The apps can also be used for the sale of lottery tickets, tobacco and energy drinks. And the UK government has said digital IDs will soon be accepted for the sale of alcohol.

In 2025, the UK government is introducing the UK Data (Use and Access) Bill which aims to foster trust in digital identities, giving them the same confidence as physical documents. This will increase adoption of digital IDs even further.

Once someone has created our Digital ID and added an identity document, they can share their verified age and nothing else. And for those without an ID, they can choose to have their age estimated within the app, using our privacy-preserving facial age estimation technology. This allows people around the world to receive an age estimate, such as ‘over 18’, and share this with businesses online.

Armed with a Digital ID, people will have an easier and safer way to prove their age. They’ll be more protected from identity theft and fraud, and have greater control over their personal data.

Speaking about the free age checks, our CEO Robin Tombs said, “It’s quite a ‘pinch me’ moment to see that through the development of this technology, we’ve made great strides in achieving our vision to let anyone in the world prove who they are, simply by being themselves”.

Free Digital ID age checks

One of our founding principles is to make Yoti available to anyone. Guided by this, we will be offering Digital ID age checks to businesses, for free, when used alongside our other age verification products. This is to help companies around the world, of all shapes and sizes, check age in the most privacy-preserving way – without cost being a barrier.

We’re able to offer these Digital ID age checks for free, because businesses pay for our other solutions, including right to work, KYC and identity verification checks.

An increasing number of online and offline businesses are already embracing Digital IDs. We’re excited to help even more businesses check the age of people in the most privacy-preserving way.

If you’d like to find out more about our free Digital ID age checks, please get in touch.