Identity verification is the process of confirming that a person is who they say they are. It typically involves validating an individual’s personal information, such as a name or date of birth, against identity documents or other official records and databases. Verifying a person’s identity is crucial for safe and trusted transactions. It helps you to protect your business from fraud, prevent deepfake attacks and comply with regulations.

Addressing misconceptions about identity verification

There’s lots of conflicting information out there about how you can verify your customers’ identities. We’re here to dispel some commonly-held myths about identity verification.

Myth: Online identity document verification is only for the tech-savvy.

You may think integrating an online identity verification service into your system is a complex process. So we’ve made the process as easy as possible, eliminating the need for significant technical resources or expertise.

With our no-code portal, you can get set up in minutes with no integration necessary. All you need to do is send your customers to a webpage to complete the identity verification process via a link. Here, you can manage all your sessions in one place.

Alternatively, our document scanning and verification software development kit (SDK) can be integrated into your website, app or kiosk for a seamless customer experience. Customers scan their documents and complete verification directly within your existing flow. We also offer 70+ integrations with the biggest SaaS platforms. These help you streamline the identity verification process into your other workflows.

Our service is designed to be user-friendly, with clear and simple instructions to guide your customers through the verification process. Our identity verification solution has achieved WCAG 2.2 Level AA for accessibility – a global benchmark for accessibility. Level AA means the solution is usable and understandable for the majority of people with or without disabilities.

Myth: Online identity document verification creates too much friction in the customer journey.

Online identity verification can actually help to reduce friction as it eliminates the need for in-person checks. It speeds up transactions, with our automated identity verification process taking just 5 seconds.

Businesses often think that customers will abandon the process if there’s friction. However, people are comfortable with some friction if they can see the reason for it. One example is using FaceID or a PIN to unlock their phones. This is a quick process that’s clearly in place for their security. Similarly, customers are comfortable with identity document verification when they understand that it ensures safe and trusted transactions.

Myth: Businesses worry that robust identity verification means a poorer customer experience.

Robust identity document verification doesn’t always lead to a poor customer experience. The right balance of security and convenience can enhance customer trust and confidence. We know a rigorous process is important, but so are quick and efficient checks.

This ensures minimal disruption to the user journey. Quick, secure and convenient document checks ultimately improve your customers’ experience.

Myth: Online identity document verification relies on 100% automation.

We believe a combination of automated technology and human oversight gives optimal results. Though our automated process is successful for the majority of checks, human intervention is sometimes required for specific cases. This may happen if the uploaded document image is too grainy, if there’s bad lighting, or for certain use cases requiring higher assurance.

Sometimes the photo on an identity document may be over 10 years old. A person’s appearance can change considerably since the photo was taken. Here, the automated technology may struggle to match the two faces, which is where our highly skilled team of Super Recognisers will step in. Together, our team of Super Recognisers, Fraud Experts and Face Matchers work alongside our technology to achieve the highest completion rates.

This ensures the process is as smooth as possible for your genuine customers.

Myth: Online identity verification is easy to spoof.

Robust identity document verification has multiple security layers that are extremely difficult to fool.

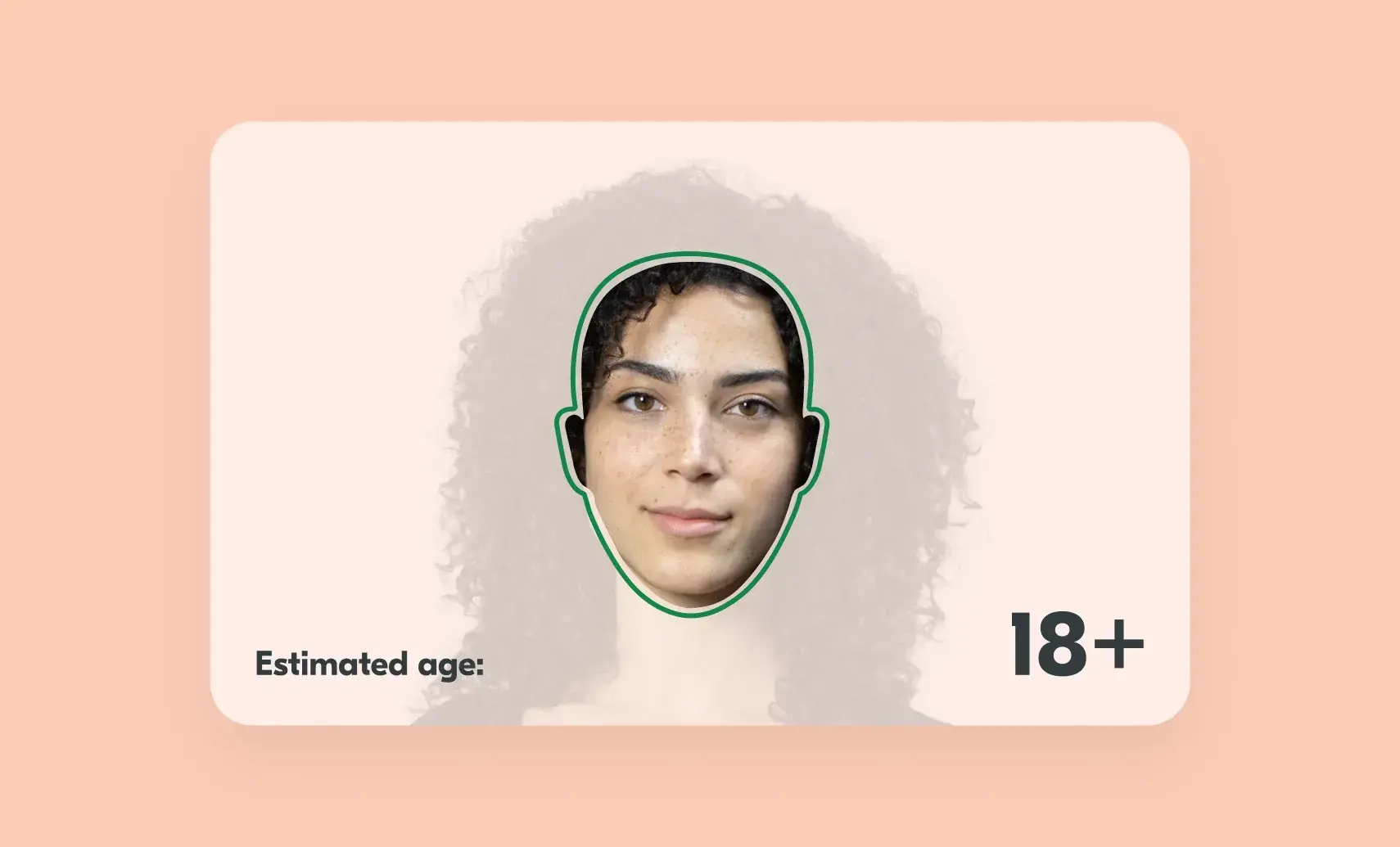

- Document authenticity checks confirm the document is valid, has not been tampered with and is not counterfeit.

- Face matching matches the image on the document to the face of the person presenting it.

- Liveness checks make sure the person behind the camera is real (and not a photo or video).

- Injection attack detection ensures images submitted for verification are genuine and are not injection attacks or camera takeovers.

Some businesses may feel that online verification can’t protect them from fraud or identity theft. But these additional verification steps help to stop any users who aren’t genuine and greatly reduce the risk of fraud.

Myth: Identity document verification is not right for my business or industry.

Online identity verification is adaptable to any industry. It offers benefits such as fraud prevention and regulatory compliance. You might think that only sectors such as finance or gambling need identity verification. In fact, any business that handles personal data, offers age-restricted services or needs to complete know-your-customer checks (KYC) can benefit from this additional layer of security.

There’s also a misconception that low-value transactions don’t need identity verification. Regardless of your product or service, protecting customer data and preventing fraud is important for every business. Even small transactions can be vulnerable to fraud. Therefore, if your business handles customer data, verifying your customers can protect both parties.

We can also customise our verification services to your business’ requirements. With expertise across multiple industries, we can provide a bespoke solution for the challenges faced by your industry. Additionally, we offer customisable country-specific checks whilst maintaining a high document approval rate across countries.

Myth: Online identity document verification excludes people who don’t own a passport or driving licence.

We strongly believe that no one should be excluded from proving who they are. That’s why alongside accepting passports and driving licences, we also accept a range of other documents, such as national identity cards. We currently accept over 12,000 documents from over 200 countries and territories, and our solution is available in 20 languages.

By being as inclusive as possible, we hope to help businesses serve a global customer base for seamless cross-border verification.

Myth: Identity verification is only for new customers.

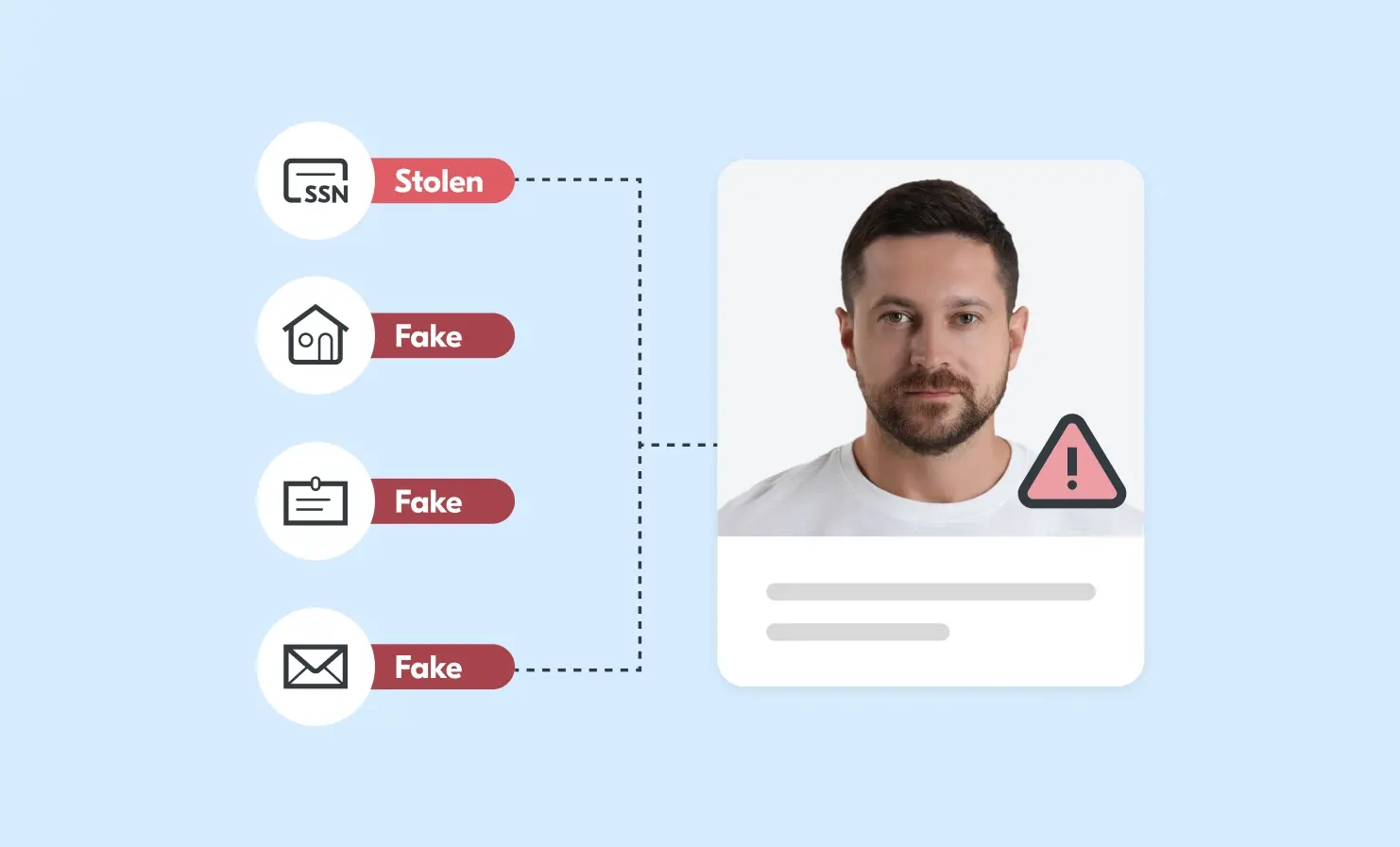

There’s an assumption that identity verification is only relevant for first-time customers. However, without repeated verification, returning customers are at risk of account takeovers. These occur when bad actors use someone else’s credentials to take over legitimate user accounts. This puts your customers at risk of identity fraud, financial losses and data theft.

Returning customers often rely on the same login credentials. However, these can be compromised in data breaches. To help prevent this, businesses should verify the identities of their returning customers, as well as their new ones, to ensure that the person accessing the account is the legitimate owner.

Alongside asking users to re-upload identity documents, businesses can also choose to accept digital IDs. With our Digital ID app, your customers only need to verify their identity details once to create a reusable Digital ID. They can then use their Digital ID to instantly access your services.

Unpacking the truth behind identity verification

A secure verification process can build customer confidence, reduce fraud risks and enhance overall trust in your business.

If you’d like to know more about the benefits of identity verification for your business, please get in touch.