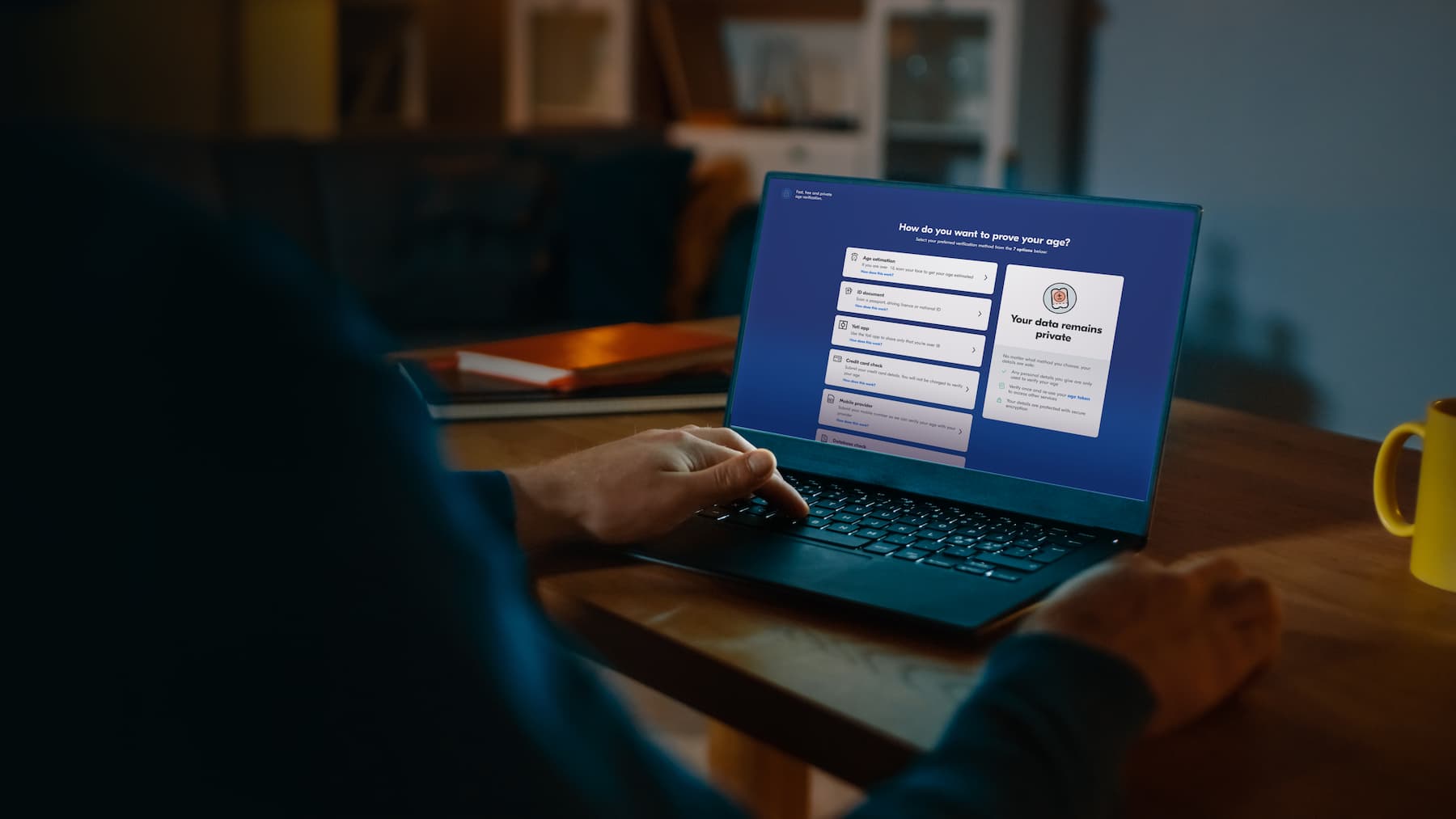

Checking age no longer has to rely on seeing an ID document. In fact, you don’t even need to see a name.

With Yoti age verification, businesses can check the age of their users without processing or storing any personal data. Users choose their preferred way to prove their age, from convenient things like a selfie or an email address. We work out the age, delete the personal data and share just the result with the business.

That way, businesses can be confident they’re delivering age-appropriate services to the right people, whilst protecting their privacy.

Here are the different ways to check age. Remember, it doesn’t matter which method someone chooses to prove their age. Yoti will always remove any personal data and share just the result of the age check.

Facial age estimation

People simply look at the camera on a device and have their photo taken.

The image is analysed by an algorithm that has been trained to determine age by analysing facial features. A robust facial age estimation process should also include liveness detection technology to ensure it’s a real person in front of the camera.

Good for:

- People without ID documents

- Global coverage

- Low friction

ID document

Your customers scan a photo ID document and take a selfie using the camera on their device.

Their ID can be analysed to make sure it’s genuine and the document photo is matched to the selfie.

Good for:

- High assurance

- Global coverage

Digital ID

Your customers scan a QR code using their digital ID app and share a verified age attribute, such as 18+ or 21+.

This requires a one-time onboarding process with an ID document and a selfie. Once created, users are verified for life and can use their digital ID to prove their age or identity details with businesses online and in person.

Good for:

- Reusable authentication

- High assurance

- Global coverage

Email age estimation

If your customers have a verified email address associated with their account, we can check if it’s likely to be associated with someone over 18 based on the reputation, usage and metadata of the email address.

A key challenge of this method is that account access is not always equal to account ownership. Further to this some users prefer to use temporary or anonymised email addresses for privacy reasons.

Good for:

- People without ID documents or a credit history

- Accounts linked to an email address

- Low friction

Credit card check

Verify your customer is over 18 using their credit card details.

This method proves your customer is in possession of a registered credit card, which in most countries, can only be issued to people old enough to sign a credit agreement.

Good for:

- Background checks

- Specific countries

Mobile number check

Verify your customer is over 18 using their mobile provider details.

Mobile phone numbers can be checked against contracts issued by mobile carriers. You should ensure the phone is in the possession of the contract holder before checking their contract and be aware parents will take out contracts for their children.

Good for:

- Accounts linked to a mobile number

- Background checks

- Specific countries

Database check

Verify your customer’s name, date of birth and address against a credit reference agency database.

In some countries, users will be on a database if they have signed a credit agreement. This may exclude those in lower income groups or younger adults and students.

Good for:

- Background checks

- Specific countries