Verified customers without the hassle

Fast and simple verification for your customers. Compliance made easy for you.

About identity verification

Get genuine customers through faster

No matter your company’s size, we’re here to make verifying customers more accessible for you. Our customisable identity verification tools give you the flexibility you need to deliver the perfect balance of speed and fraud prevention at exactly the right time.

Genuine customers will fly through your automated checks and our 200+ strong team of verification experts can help you with those trickier submissions.

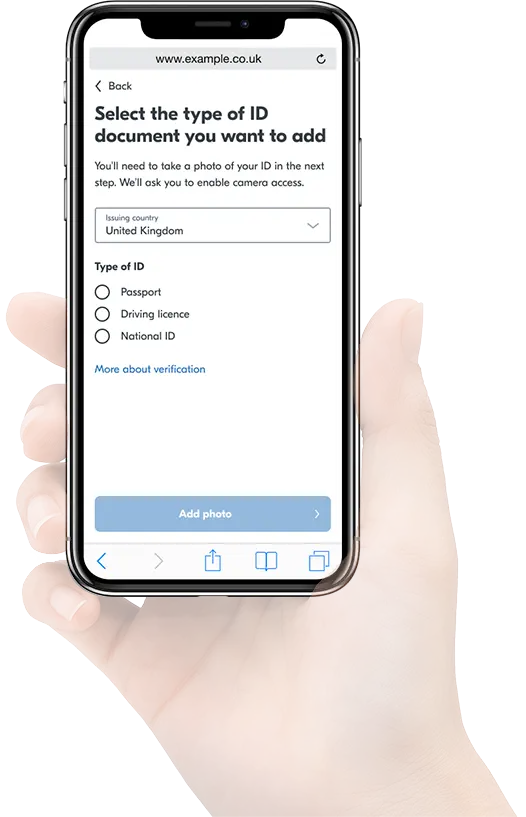

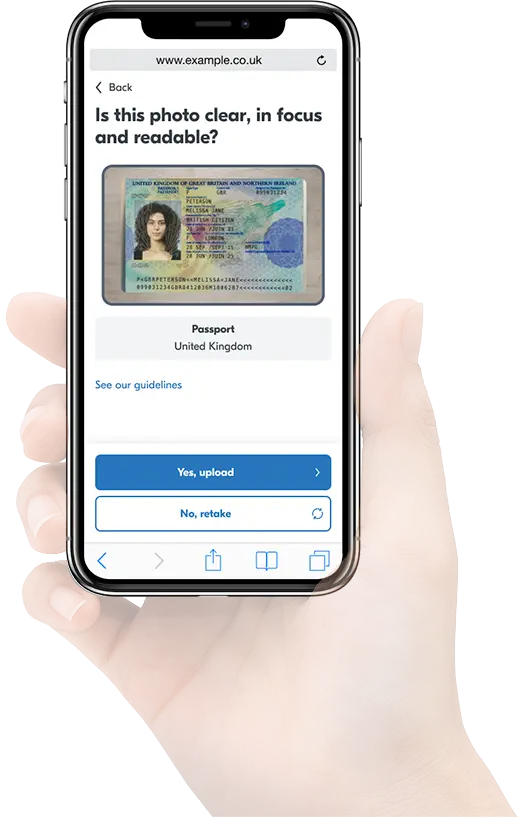

User flow

How it looks for your customers

Our simple UI makes identification verification a seamless process for your customers. Whether you’re after our core identity verification or additional checks for enhanced security, these can all be added to the same user flow.

Any additional checks happen in the background to make sure the user journey is as frictionless as possible for your customers.

Core verification process

How we verify your customers

Our core identity verification process is flexible to suit your requirements. Our automated processes keep verification speedy for your customers, supported by an expert team of document checkers and super recognisers to make sure no fraudsters can pass your checks.

Accurate data extraction

Extract data from thousands of ID documents from 200+ countries using Optical Character Recognition (OCR), cross-matched between multiple providers for higher assurance.

Document authenticity check

Be sure it’s a genuine document with advanced AI-driven authenticity checks.

Liveness

Make sure it’s a real person in front of the camera with a combination of NIST-Level 2 anti-spoofing liveness technologies.

Biometric face match

Match the image of the user’s face to their ID document photo with cutting-edge biometric face match technology.

Additional checks

Enhance your identity verification

For more robust customer verification, these additional checks can be completed by your customer in the same verification flow.

Proof of address

To receive a customer’s verified address or further proof the customer is who they say they are, they can upload a supporting document like a utility bill or bank statement.

Third-party data checks

Verify the customer’s name, date of birth or address against records from a centralised database, including American Automotive Mobility Validation Association (AAMVA), Credit Reference Agencies (CRA) and Australian DBS.

AML watchlist screening

For high-risk use cases, we can check a customer’s information against a global database of sanctions and watch lists, Politically Exposed People (PEPs) and adverse media.

KYC/AML compliance

Stay compliant and protect your business from fraud

Don’t let outdated systems hold your institution back. Screen extracted customer information against award-winning AML data during the onboarding process.

We connect to thousands of global sanctions and watchlists, PEPs and adverse media in real-time, allowing you to detect risk and react quickly.

Why not automate the ongoing monitoring process too? Get alerts to changes in risk status in real-time and make sure your compliance team don’t miss a thing.

Scale globally

Strike your perfect balance of fraud prevention and speed

There’s no one-size-fits-all when it comes to customer verification. It all comes down to the markets you operate in and who you serve. We help you tailor your optimum balance of automation and human experts, so you can handle spikes in volume and documents from anywhere in the world.

95% automation rate

Our AI-led verification process means you can onboard genuine customers quickly. You’re looking at around 8 seconds for automated checks and for Android and iOS users with ePassports, it’s instant.

200+ verification experts

Set your risk levels for your automated checks and our human specialists will be there to help you handle the trickiest submissions. Armed with the latest technology, they’re your first line of defence to prevent fraud and analyse patterns.

For our biggest international clients, we process over 1,000 documents from 200 countries, with 100% document process rate and 90% approval rate.

Integration

Choose the implementation that suits your business

No-code portal

Tailored to small and medium enterprises, the Yoti-hosted portal is suitable for low-volume checks. With no integration necessary, you can send your customers to the portal via a simple link and manage all sessions in the one place.

Embedded verification

Our document scanning and verification SDK can be integrated into your website, app or kiosk for a seamless customer experience. Customers scan their documents and complete verification directly within your existing flow.

Our partnership

In-branch verification

We’ve partnered with Post Office in a unique union that brings together a world-leading suite of online and in-person identity verification solutions to the UK market.

Take advantage of Post Office’s branch network and give your customers a convenient way to prove their identity in person, powered by our verification technology.

Compatible with Yoti ID

Get verified details from a Yoti ID

Give your customers another convenient way to verify their identity using Yoti ID.

We verify Yoti users and their ID documents to the same high security standards as our core verification process. Once verified, users will have a reusable digital ID they can use to share their details with your organisation in seconds.

Contact us

Questions about how Yoti can fit into your business?

Fill out this form and our sales team will be in touch to find a solution that works for you.

Not a business? Visit our consumer help centre for help using our products.