Yoti blog

Stories and insights from the world of digital identity

Royal Voluntary Service partners with Yoti to verify volunteers and create trusted communities

The Royal Voluntary Service (RVS) has launched GoVo, a free-to-use digital volunteering platform, which aims to revolutionise the recruitment of volunteers to opportunities from UK charities by bringing volunteering opportunities from charities across the UK into one easy place. It is designed to make it easier than ever to get involved in volunteering and give back. We’ve partnered with RVS to help them create trusted communities within the GoVo platform. Many volunteering opportunities can involve working with the vulnerable, the young, the elderly, or otherwise in-need communities. A vital aspect of this is safeguarding both volunteers and those beneficiaries

BAT and the Channel Islands Coop roll out Yoti facial age estimation in stores to combat underage access

BAT and Channel Islands Coop have partnered to launch Yoti facial age estimation technology in stores across Jersey. The initiative aims to combat underage access across all age-gated product categories Forms part of BAT’s large-scale facial age estimation technology deployment in more than 600 stores across Europe Early results from BAT pilot in Europe show a 99% accuracy rate. 99.3% of 13 to 17 year olds will be correctly estimated as under the age of 21* London, UK – 16th October 2025 – British American Tobacco (BAT) has announced it has partnered with The Channel Islands Co-operative Society

Luciditi join Yoti, Post Office and Lloyds Bank to grow the UK’s network of interoperable digital ID wallets

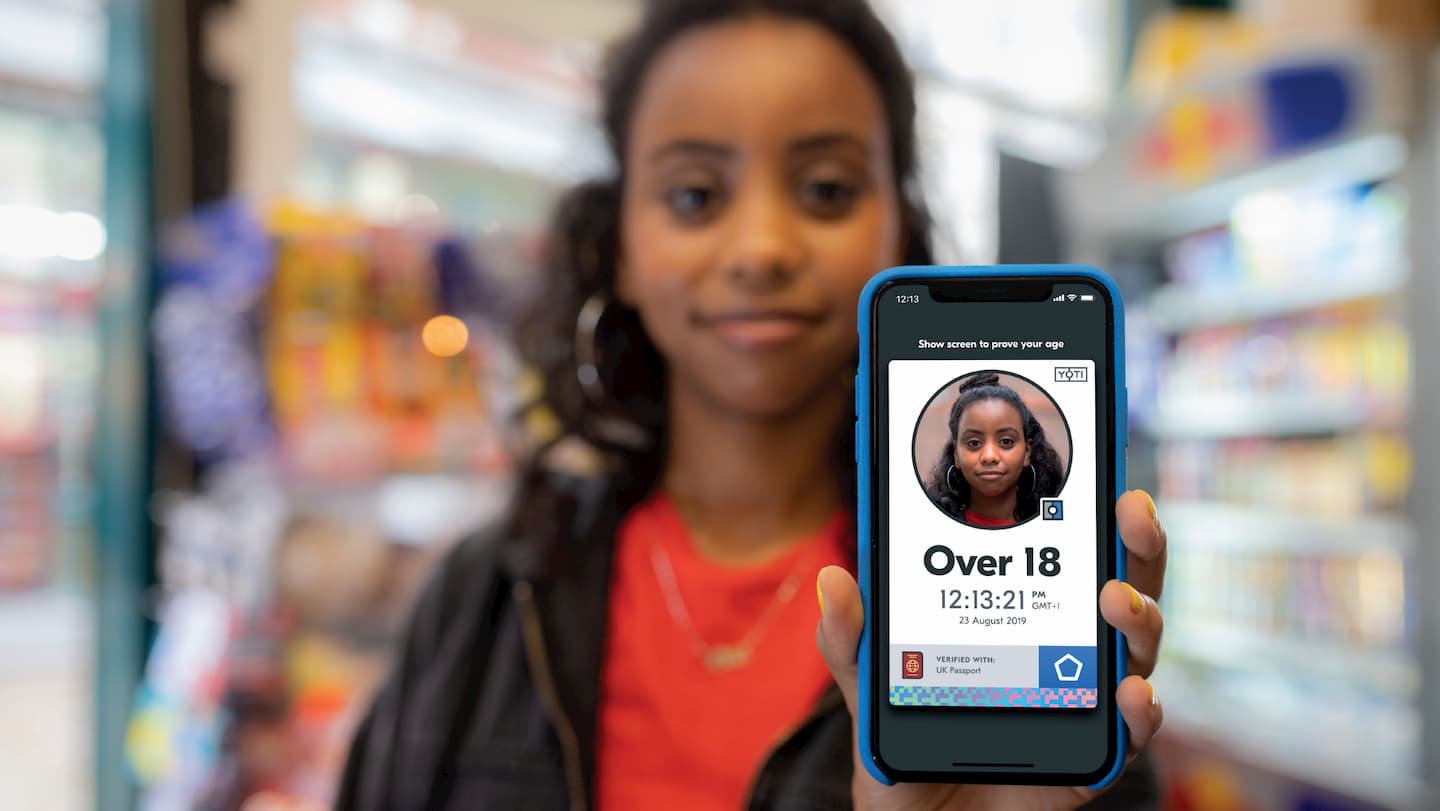

British reusable digital identity providers, Yoti and Luciditi, today announce that they are working together to further grow the UK network of interoperable digital ID wallets available to businesses needing to verify customers’ ages, both online and in person. This 7 million strong UK network now includes Yoti, Post Office EasyID, Lloyds Bank Smart ID, and Luciditi meeting the demand for secure, efficient and trusted digital ID wallets for the UK market. All four Digital ID wallets are certified to the UK Government’s Digital Identity and Attributes Trust Framework. Individuals create and manage their reusable Digital ID on their

Thoughts from our CEO

In this blog series, our CEO Robin Tombs will be sharing his experience, whilst focusing on major themes, news and issues in the world of identity verification and age assurance. This month, Robin talks about Yoti’s performance in Australia’s Age Assurance Technology Trial, New York’s SAFE for Kids Act and public perceptions of the Online Safety Act. Yoti’s facial age estimation technology achieves independent validation and success Yoti has waited a long time to see independent, high-profile and well-funded technology trials of our facial age estimation technology. We’re delighted to read the results which have just been published in

Digital IDs are already here and working

The conversation around digital IDs in the UK is gaining pace. The government is exploring the introduction of a mandatory national digital ID, with some even pushing for physical national ID cards. The upcoming GOV.UK Wallet app will enable over 40 million drivers and over 50 million passport holders to store government-issued credentials. Whilst this is generating debate, it’s important to recognise that the UK already has a secure, privacy-focused digital ID system in place. This is with the Digital Identity and Attributes Trust Framework, known also as DIATF. This framework isn’t a competing model to the government’s digital

Freshers' Survival Guide: Why you'll want Yoti on campus

Going to university is one of the most exciting times in your life. However, we know there’s a lot to juggle with adjusting to a new environment, meeting new people, managing your workload and discovering the freedom of living away from home. Thankfully, we’ve got the technology to help make your transition to university life smoother. We’ll walk you through how the Yoti Digital ID app can help you with everything from proving your identity for part-time jobs to getting discounts and even future-proofing your social life. Here’s how Yoti can help you out. What is a Yoti

Browse by category

Essential reading

Get up to speed on what kind of company we are