How AI and machine learning can help build better AML programs

As financial institutions move towards FATF-recommended risk-based AML programs, artificial intelligence (AI) and machine learning can help them be more effective and efficient in the fight against financial crime. The global framework for fighting financial crime white paper by The Institute of International Finance and Deloitte LLP highlights that: There is growing consensus that the current global framework for fighting financial crime is not as effective as it could be and that more needs to be done at the international, regional and national levels to help identify and stem the flow of illicit finance – an

Regulatory expectations are evolving: How robust is your AML program?

Managing financial crime is very complex and presents several challenges for financial institutions to develop robust anti-money laundering (AML) programs and meet compliance requirements. AML compliance officers understand the importance of keeping one step ahead of criminals trying to find weak points in their financial systems to exploit. Continuous discussions by industry leaders at the forefront of combating financial crimes agree that more needs to be done sooner to detect and prevent money launderers from misusing systems. Thought leader Kevin Buehler from McKinsey wisely points out that “the stakes in this fight have never been higher

A closer look at the ever-changing anti-money laundering landscape

In the fight against financial crime, the anti-money laundering landscape is ever-changing. The global battle against financial crime is a challenging one fought by governments, regulatory bodies, and industries. Every financial institution and organisation that provide financial services must better equip themselves against the growing threat of money laundering. Financial institutions are the most significantly impacted by money laundering and terrorism financing year on year. The United Nations Office on Drugs and Crime estimates that the amount of money laundered globally is between 2 – 5 per cent each year, which in USD is between

How AvantiGas reduced their contract signing cycle by 75% with Yoti

“For our requirements, Yoti delivered exactly the same functionality as the market leaders, but for a fraction of the cost. The staff at Yoti have been helpful and accommodating all the way through. They communicate with us on a regular basis to make sure the product is appropriately adopted and as well as informing us about the latest improvements.” Simon Ashton Project Manager at AvantiGas AvantiGas is one of the UK’s leading suppliers of versatile, renewable and safe off-grid LPG (Liquefied petroleum gas) energy solutions. We helped them: Reduce their contract signing process

A guide to the European Commission’s proposed legal framework for regulating high-risk AI systems

On 21 April 2021, not long after a leaked portion had caused a stir, the European Commission published its proposed legal framework for the regulation of artificial intelligence (“AI”). Whilst only a first draft, therefore subject to the push and pull of the amendment (or ‘trilogue’) process over the coming months, it marks an important milestone in the European Commission’s journey to engender a culture of ‘trustworthy’ artificial intelligence across the European Union. The proposal has important implications for the developers of biometric systems, like Yoti. Although it will undergo a number of revisions before the

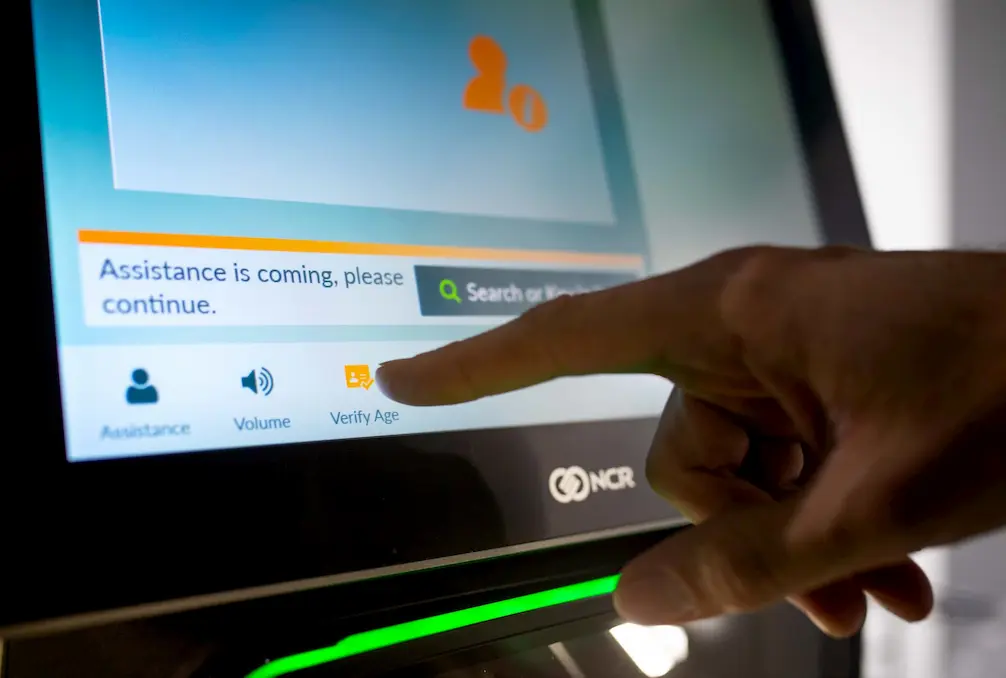

Automated age checks for StrongPoint

We’ve teamed up with StrongPoint to deliver automated age checks in their self-checkouts, Click & Collect lockers and Vensafe dispensing machines. Customers can simply look into the camera on the device and have their age anonymously estimated in seconds. If they look under the configured age threshold, they can prove their age with the Yoti app. Products: Facial Age Estimation, Digital ID Read more about transforming your shopping experience